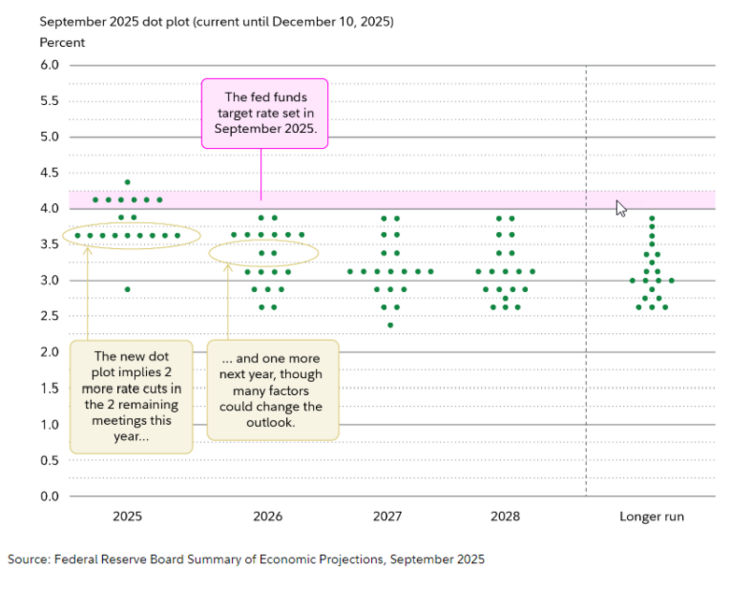

The Federal Open Market Committee (FOMC) is expected to cut rates by 25bp at the Oct. 28-29 meeting, following through with projections in the September dot plot, which were implying two more rate cuts in the two remaining meetings this year 2025. Fed Chair Jerome Powell will likely characterise the cut as insurance against downside risks to employment. While the government shutdown has delayed official data, alternative data suggest continued downside risks to employment. Policymakers have little reason to adjust their outlook from September, keeping another cut on the table for December.

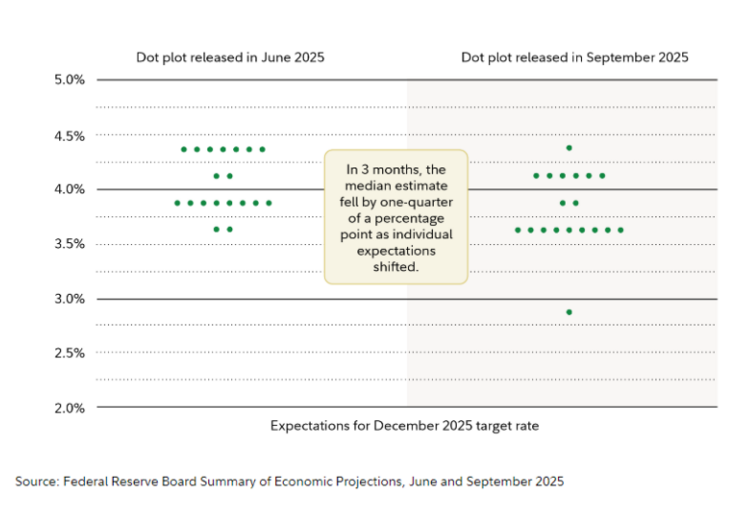

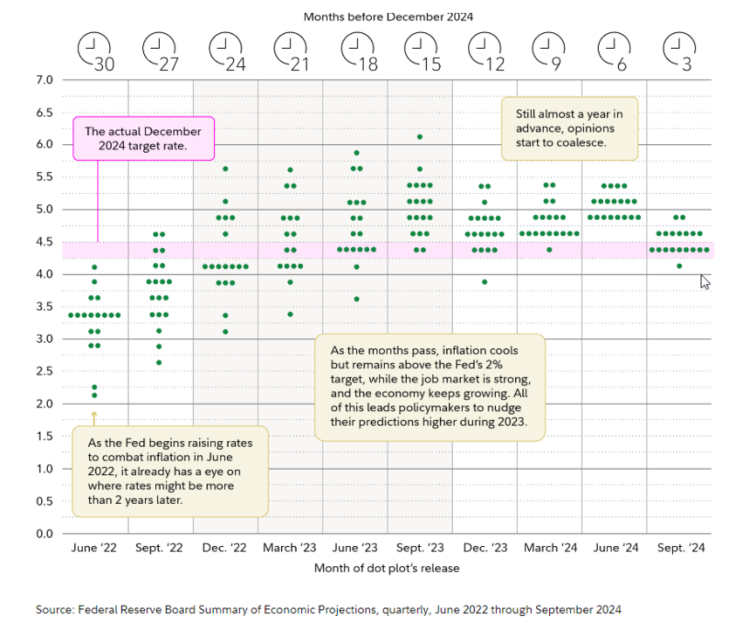

FED "Dot Plot"