Current threats to the dollar

However, investors are now questioning whether the US is still the safe haven it used to be. The dollar index has depreciated by more than 8% since the start of the year, and the yield on 10-year Treasury bonds has increased by 50 basis points in the week following ‘Liberation Day tariffs’. Downside growth risks and upside inflation risks have pushed investors to demand more compensation for taking duration risk (a bond portfolio's sensitivity to interest rate changes). There is also growing anxiety about the government's ability to manage debt in a slow-growth environment, and unease about lower foreign investors demand for US Treasury bonds.

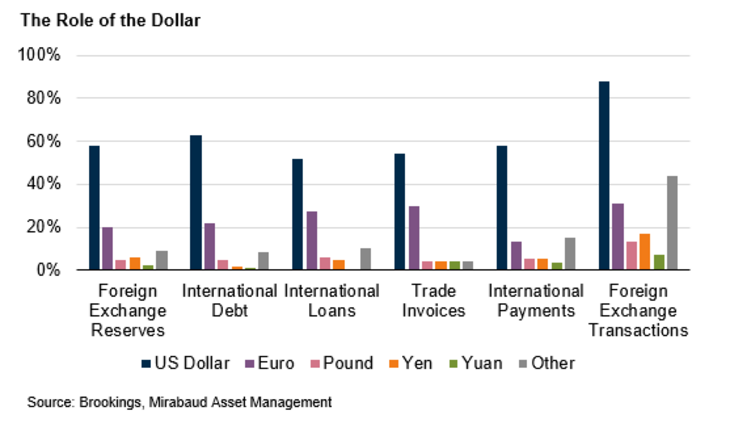

The role of the dollar as reserve currency has also declined as sanctions imposed by the US and its allies on Russia following the invasion of Ukraine – freeze of half of its official foreign reserves, ban of selected Russian banks from the international payment system SWIFT – led Russia to diversify away from dollar into renminbi and gold.

Are there any alternatives?

A narrative is now emerging among investors that we are seeing the end of US exceptionalism. However, alternatives to the dollar often lack the depth, liquidity and other financial attributes required to appeal to global investors. In fact, while the eurozone financial markets are also large, they are fragmented across different countries and the euro does not have the same global reach as the dollar. As for the yuan, it still faces many challenges, including strict control over capital flows in China and a legal system that does not fully adhere to the principles of the Rule of Law. It would then require some major structural changes to dethrone the US dollar, and it would take time.

Over the short to medium term, uncertainty around trade policy will continue to weigh on the dollar. A decline in its role as a safe-haven currency could bring it closer to purchasing power parity, which is the rate of currency conversion that tries to equalise the purchasing power of different currencies by eliminating the differences in price levels between countries. According to this theory, a half-way correction in the fair value of one euro would be around 1.25 dollars, representing a further 10% depreciation of the dollar.