In response, many leading U.S. corporations are turning to Europe to issue debt, attracted by greater stability, lower yields, and robust demand—especially as the European Central Bank is poised to continue lowering its key interest rate.

Take Pfizer as a case in point. In 2020, the pharmaceutical giant issued a 10-year dollar bond with a risk premium of 185 basis points above the U.S. Treasury yield, resulting in a 2.625% coupon. By 2023, Pfizer returned to the market with a tighter risk premium of 125 basis points—reflecting improved credit quality—but the coupon had risen to 4.75%. The explanation? The 10-year Treasury yield had climbed sharply from 0.70% to 3.65% over three years.

Today, with an even lower risk premium (85 basis points), Pfizer would face a coupon of 5.30%.

In May, Pfizer opted for a different strategy, tapping the European bond market to issue €750 million in 12-year notes with a 3.875% coupon. While this introduces currency risk, Pfizer’s global footprint and euro-denominated cash flows allow it to manage these exposures effectively. The difference is striking: total interest expense on the euro bond is around €290 million, compared to nearly $400 million had the issuance been in dollars.

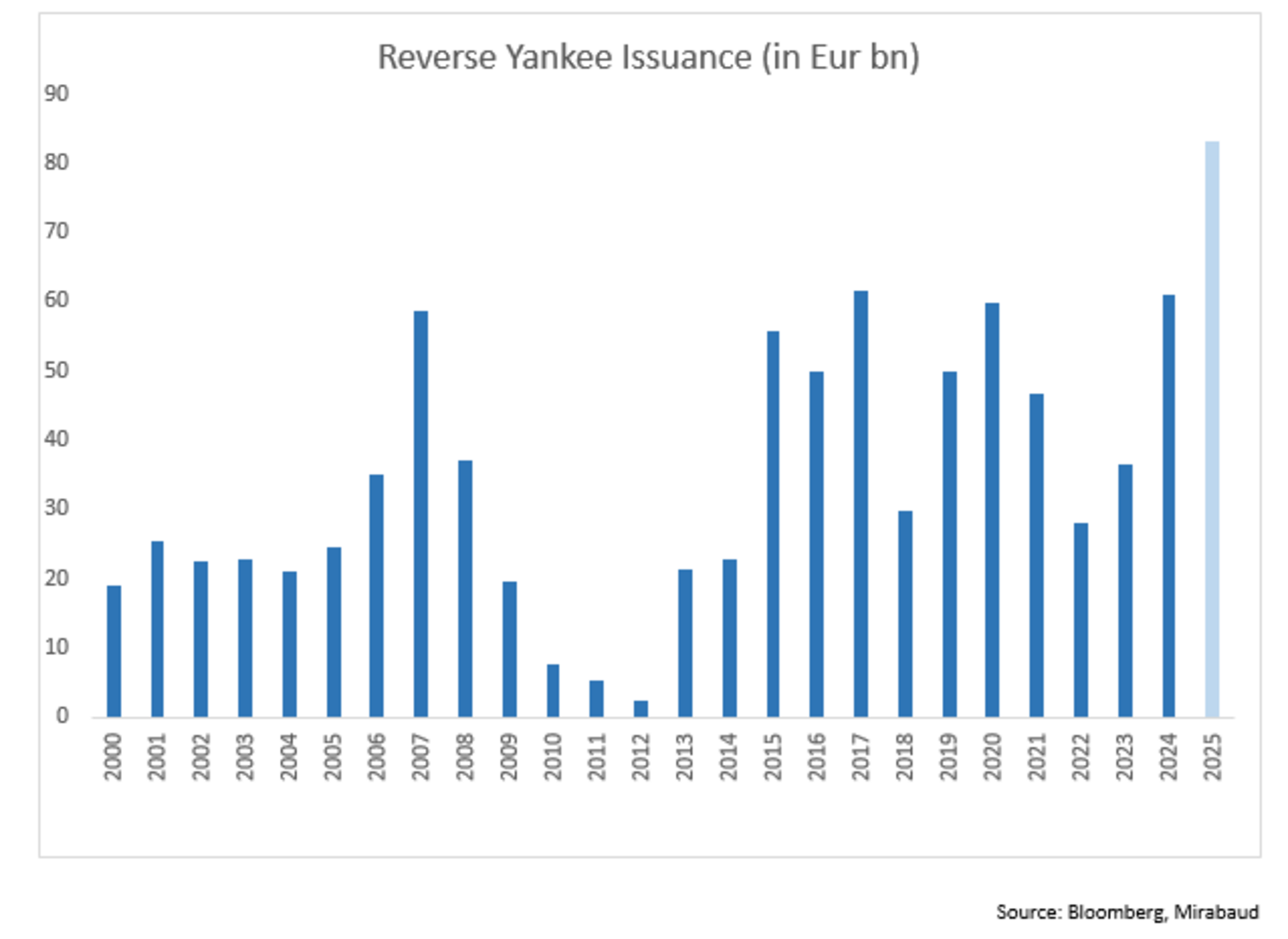

So far this year, U.S. issuers have raised more than €83 billion in the European market—a 35% increase over 2024, marking the fastest growth on record and accounting for 14% of all euro-denominated issuance. Most notably, for the first time ever, there is now more U.S. corporate debt (Reverse Yankee) than French corporate debt circulating on the European bond market.