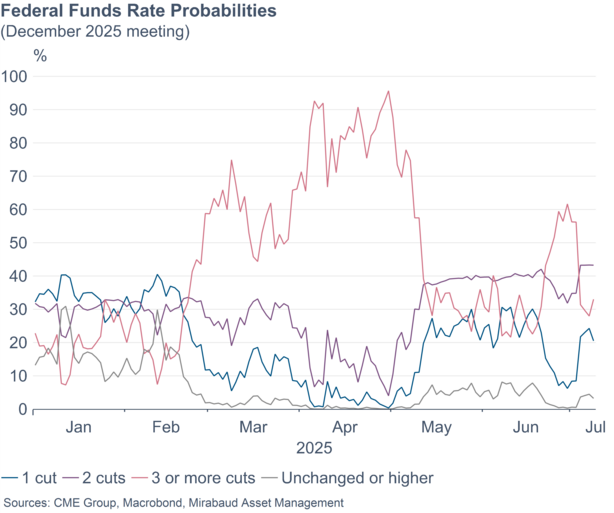

In recent years, the Federal Reserve has faced increasing political pressure, particularly from former President Donald Trump. Trump publicly criticised Chair Jerome Powell for maintaining interest rates in the 4.25%–4.5% range, advocating instead for a sharp cut to around 1.0%. He accused Powell of costing the U.S. economy “a fortune” and even floated the idea of replacing him before the end of his term in 2026.

Asset Management

The Federal Reserve: Political pressures, credibility, and institutional safeguards