Swiss economic growth is expected to remain relatively stable next year, at just over 1%. The economic recovery in Europe should have a positive impact on the Swiss economy, while monetary policy will remain accommodative and the reduced tariffs imposed by the United States should provide some relief to the industrial sector compared to the initial situation.

For manufacturing companies, growth in employment and investment is expected to remain moderate, with wages expected to rise by around 1.3% in 2026, a slowdown compared to 2025. While some sectors are showing resilience, external pressures, particularly US customs duties, are weighing on the business climate. Private consumption will continue to be the main driver of growth, although downside risks related to employment and purchasing power remain. Inflation expectations remain subdued, with a downward trend driven by the strength of the Swiss franc and a slight slowdown in the services sector.

In the longer term, inflation is expected to stabilise at around 1.1%, within the fluctuation margin defined by the Swiss National Bank (SNB).

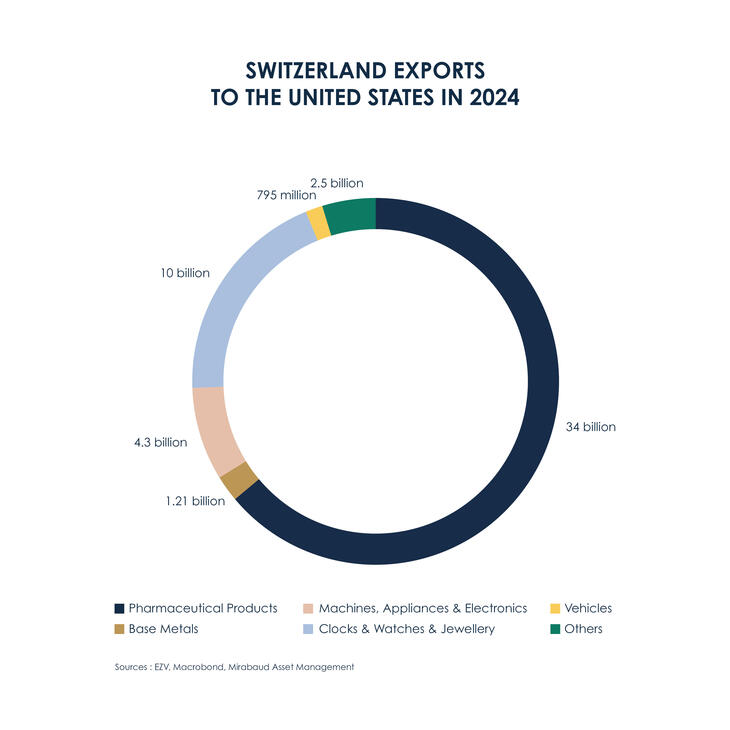

US trade policy remains a major risk for Switzerland, despite the reduction in tariffs to 15% from the current 39%. The pharmaceutical sector has been spared for the time being, but customs duties could be announced between now and the end of the year. It should be noted that only 6% of total Swiss exports are currently affected by US customs duties. Furthermore, around 20% of Swiss companies report being directly or indirectly affected by these tariffs. While this situation is certainly causing considerable uncertainty regarding industrial investment, the negative effects remain confined to export sectors and are not spreading to the whole economy, particularly sparing the service sector, thus limiting concerns.

Current monetary policy remains expansionary, and the key interest rate cuts of 2025 will continue to have a delayed effect in supporting real economic activity.