Sustainable and Responsible Investing

Biodiversity loss is also a risk for businesses

Sustainable and Responsible Investing

Although criticised for their lack of enforceability, these commitments have the benefit of addressing the problem in its full complexity whilst involving private stakeholders in defining solutions. The global framework established at the end of the COP includes the active participation of large multinational companies and financial stakeholders alongside member states in order to achieve this. The activeness shown by some companies and financial institutions is a reflection of their reliance on natural capital and their exposure to environmental risks.

On 19 December 2022, government officials from 196 member states of the United Nations Convention on Biological Diversity successfully reached a global agreement at COP15 in Montreal. A new global framework has been adopted under the leadership of China, with the aim of halting the decline of biodiversity by 2030. Given the repeated and resounding failures of previous conferences on this topic, the summit, which has come two years late as a result of the pandemic, is delivering what many experts see as unexpected results. Although the 23 targets that have been set are not legally binding, they appear ambitious, if one considers, for example, the target of preserving and restoring 30% of land and sea by 2030 (only 17% of land areas and 10% of sea areas are currently protected). Another key objective is a commitment to halve the use of pesticides, chemical pollutants, food waste and to eliminate plastic pollution by 2030. The willingness to dramatically reduce public subsidies to industries, such as that of fossil fuels, whose activities contribute to the destruction of ecosystems and the extinction of species, should also be noted. These subsidies are estimated to be worth USD 1,800 billion per year, representing 2% of global GDP.

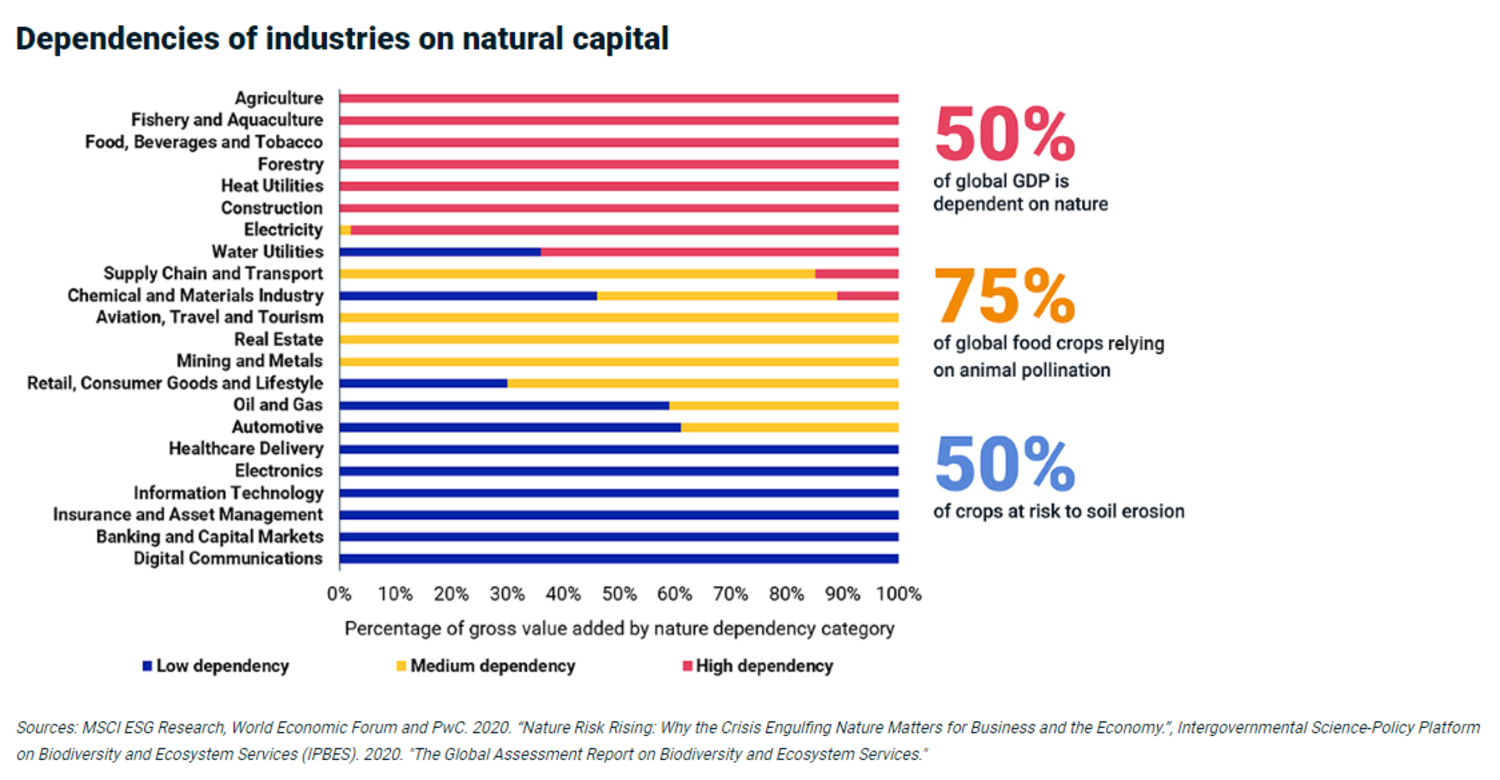

Climate protection, which is undeniably a global emergency, still overshadows biodiversity within public debate and in the actions of private and public stakeholders. However, especially over the last 50 years, human activities have accelerated the negative impacts on “natural capital” as a combined consequence of population increase and economic growth. The speed and extent to which nature is deteriorating is unprecedented if we consider deforestation (32% of the world’s forests have been destroyed since 1970). The acclaimed World Economic Forum (WEF) ranking recognises biodiversity loss, along with climate change, as one of the five greatest risks facing the planet. Business leaders actively participated in COP15 alongside State officials in Montreal, confirming that this issue is now firmly on the business agenda. Over 330 companies and financial institutions, including Nestlé, BNP Paribas and Roche, have called on governments to make the evaluation and disclosure of their environmental impacts and dependencies obligatory in their “Make It Mandatory” campaign. All businesses, either directly or through their supply chain, depend to varying degrees on “natural capital”, i.e. assets or services provided by nature, such as water, land, plants, etc. A recent WEF study estimated that almost half of the world’s GDP, equal to USD 44,000 billion of economic activities are highly or moderately dependent on nature, and are therefore at risk with regard to biodiversity loss. Construction, agriculture and food sectors are particularly exposed to economic risks such as deforestation. This is the case for coffee producers, for example, who are at risk from the declining number of coffee varieties.

The involvement of companies and financial market players is consequently one of the key achievements of the COP15. One of the 23 goals of the summit specifically addresses the implementation of measures to encourage companies and financial institutions to be more transparent regarding their reliance on natural capital and their impact on biodiversity (goal 15). One criticism levelled at the goals, and at this one in particular, is that the courses of action remain hazy, and the mechanisms for their implementation are still weak. In this case, the global framework fails to provide standardised indicators for companies to communicate clearly on issues such as deforestation or food waste. However, one encouraging aspect is that private initiatives are now emerging to fill this gap, including the one put forward by the Taskforce on Nature-related Financial Disclosures (TNFD). The TNFD, which is the equivalent of the TCFD framework for climate, aims to provide practical guidance to companies in areas such as governance, management and disclosure of biodiversity-related risks. From an investor’s point of view, initiatives are also taking shape, such as Nature Action 100, which seeks to engage 100 companies in discussions to make their practices more sustainable on this issue. A bank such as BNP Paribas, for example, will make its financing of commodity trading companies’ activities dependent on the implementation of deforestation targets (e.g. for soybeans).

In summary, despite criticism raised about the lack of clear and legally binding commitments, this COP on biodiversity (finally) represents a step forward for the protection of nature and its diversity. The summit raised awareness, established a consensus on objectives and involved companies and investors in defining solutions to reduce their exposure to this important risk.

Diese Veröffentlichung wurde von Mirabaud erstellt. Sie ist nicht zur Verteilung, Verbreitung, Veröffentlichung oder Nutzung in einer Gerichtsbarkeit bestimmt, in der eine solche Verteilung, Verbreitung, Veröffentlichung oder Nutzung untersagt wäre. Sie ist nicht für Personen oder Unternehmen bestimmt, an die die Übersendung dieser Veröffentlichung rechtswidrig wäre.

Mehr lesen

Weiter zu

Sustainable and Responsible Investing