Discretionary Management

Investing assets in a constantly changing environment requires dedication, cutting-edge expertise as well as a long lasting experience in investment.

By choosing a discretionary management mandate, you are entrusting your assets to Mirabaud and you will benefit from the advice of our large array of experts in accordance with your investment profile.

A robust investment process

The key to reaching your financial objectives is to select a tailored investment strategy.

Your dedicated Relationship Manager will partner with you in choosing the best possible strategy based on your overall wealth ambitions.

At every step of the way, our private Client specialists work hand in hand with a group of world-class experts: the Investment Committee, The Portfolio Management Team, Financial Research and Product Committee, to meticulously formulate and implement your portfolio investment strategy.

Thanks to a personalised Mirabaud approach, your portfolio will be crafted around three principles: independence, conviction and active management.

There are four key steps on the Mirabaud Investment Process

- Strategic Outlook – Our experts begin by analysing the economic and political environment to formulate a forecast, while identifying opportunities for the medium and long-term.

- Tactical Asset Allocation – The next step is understanding your risk profile and investment horizons, taking into consideration any constraints you may have in terms of tax, liquidity and return expectations. The Investment Committee crafts an investment strategy specific to your risk appetite, while ensuring a tactical tilt within your portfolio.

- Investment Solutions – Following extensive fundamental and quantitative research based on our internal proprietary models, the Mirabaud product Committee selects investment solutions that are the best fit for you.

- Execution and Monitoring – Through actively managing your investments, we continually analyse performance, manage risk and keep you updated with personalised reports.

Our Investment Committee handles ongoing monitoring, including economic assessments, monetary policies reviews, financial analysis, and technical analysis.

Our strategies

Signature Mandate

Strategies combining liquid and Private Assets within a unified framework designed for long-term investors. This strategy embodies our wealth management philosophy, offering dynamic exposure to private markets while preserving liquidity through carefully selected listed assets.

Tradition Mandate

Strategies built exclusively around liquid financial instruments, excluding Private Assets. This strategy is suited to investors seeking transparent, flexible portfolio management, with the ability to express specific market views while maintaining full liquidity at all times.

Bespoke Mandate

Individually designed strategies tailored to your specific objectives, preferences, and constraints. Built in close collaboration with you, this strategy ensures that the entire asset allocation reflects your unique investment vision, offering a fully personalised wealth management experience.

The four investment pillars

Macro-economics and trend analysis

Our macro-economic research defines key market scenarios and long-term trends. These insights guide the Investment Committee’s strategic views and inform portfolio positioning.

Private assets

From real estate to venture capital, Private Assets offer long-term value. We provide selective access to this asset class, recognising its key role in diversified portfolios.

Thematic convictions

We identify major themes, such as technology, inflation, geopolitics, that shape markets. These convictions help uncover opportunities and manage long-term risks.

We integrate ESG principles across our strategies, offering responsible investment solutions that align financial goals with sustainable impact.

Contact us

Interested? Contact us to explore the right strategy for your portfolio.

Wealth management

Ian FIANDER

Head of Portfolio Management

Wealth Management services

A solution for all unique needs

Wealth Management

Wealth Planning

To get a clear picture of your needs, your wealth must be analysed as a whole, including specific aspects of international mobility and family legacy planning. We take into account the desired future and define your needs in terms of security and growth.

We provide institutional-quality access to private assets investments — designed to enhance your portfolio’s performance with long-term value creation.

A partnership based on trust, proximity and focused on the long term.

Wealth Management

Sustainable and Responsible Investing

To achieve Mirabaud Group’s economic responsibility goal of offering a comprehensive range of responsible and sustainable products and services, at Mirabaud Wealth Management, we aim to deliver high quality products and services that integrate ESG considerations.

The View

Discover our latest insights

Every day, our experts deliver fresh insights on trending topics, sectors and markets to help you stay ahead of the curve.

Source: Mirabaud GTS

The current global economic backdrop has resulted in an acceleration in the pace of C-Suite executives jumping ship. On the other hand, company boards are having to assess the inbound economic hurdles and prepare for a potential downturn by hiring executives that are experienced in being defensive through a recession, taking costs out of the business and restructuring operations.

This has several consequences for investors, not least because it highlights the ‘G’ in ESG. But bringing in a new management team can often be a way of clearing the decks and kitchen sinking guidance, which could lead to a more confessional earnings outlook in the hope of passing any bad news on with the departing management. The pace of the departures may not be coincidental with the fact that companies need to start thinking about 2023 guidance. Beyond this, changing management causes disruptions to operations especially if they do not have a replacement lined up, which in turn can dent investor confidence and ultimately lead to share price declines. This means that investors must be even more forensic in their assessment of a companies’ management and be wary of those sectors that have higher churn.

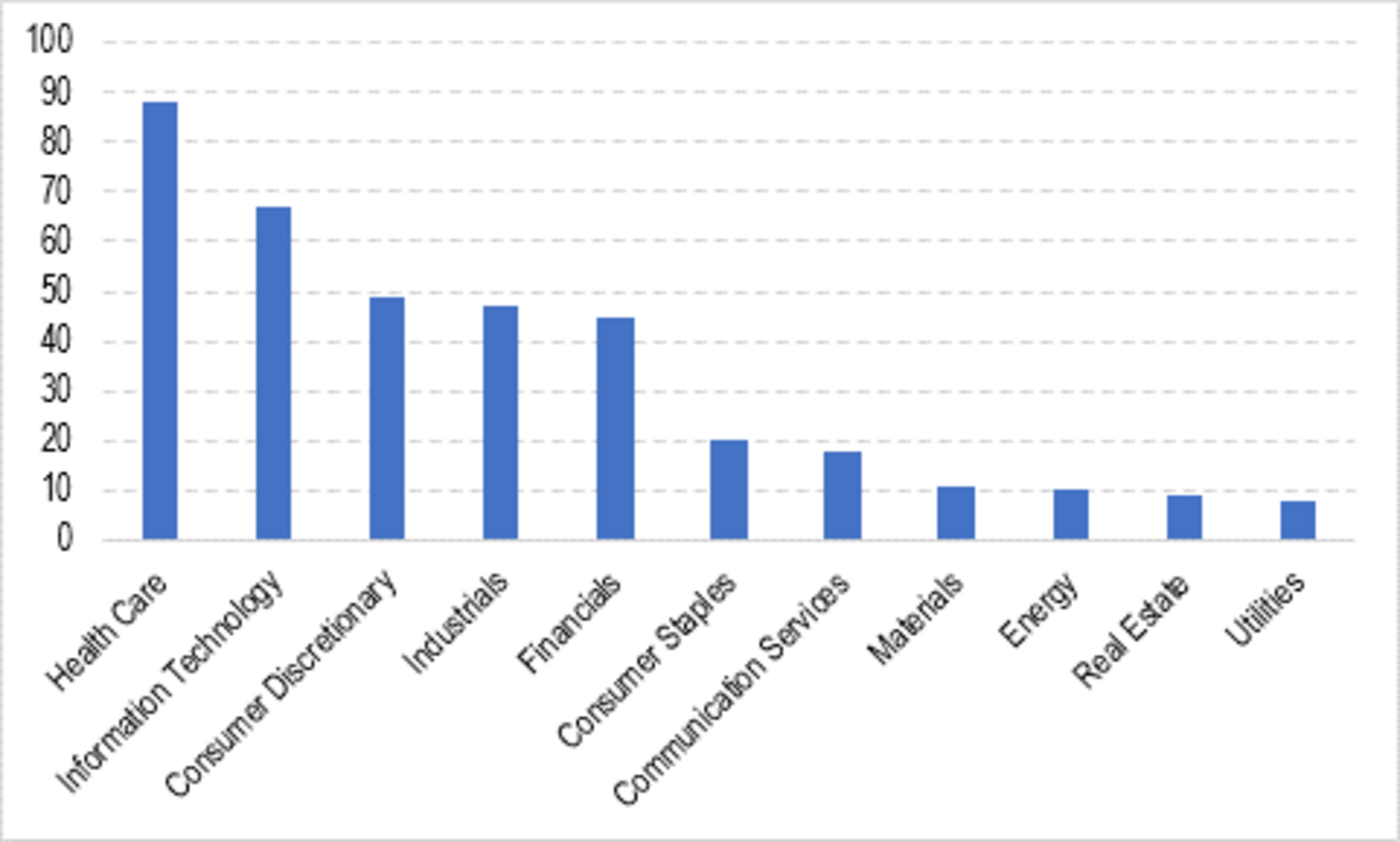

Compiling data on CEO and CFO movements across the NASDAQ Composite, S&P500, STOXX600 and FTSE100 indices we have found that the Health Care and Technology sectors generally see the highest management re-shuffles whilst Materials, Energy, Real Estate and Utility companies see significantly less top management movement.

Source: Mirabaud GTS

Last year was itself big for top management changes, however, 2022 is not far behind and on a monthly viewpoint, the pace of executive changes has moved significantly higher than in the prior year, suggesting 2022 could finish higher. Finally, comparing C-Suite movements of today versus the GFC (Global Financial Crisis), we notice that not only is the level of movement 5x or 6x higher but also that in the GFC, more CEOs were changed than CFOs. There is a myriad of reasons as to why this could be, for example, from an investor perspective the changing of a CFO is seen as less damaging than changing the CEO or perhaps in a financial world dominated by the minutiae of financial models, investors place more responsibility on the CFO than CEO. For 2022, we suspect greater importance is being placed on having a CFO who is experienced with cost control and balance sheet management.

The pace of the change has stepped up in recent months and investors need to be mindful. Gauging the reason for the change is perhaps more important now than ever before as it could be used to mask an underlying decline within the business or in anticipation of a wave of cuts and operational reorganising. Indeed, the ‘G’ in ESG becomes more prevalent at a time of economic decline.

Important information

This publication is prepared by Mirabaud. It is not intended to be distributed, disseminated, published or used in any jurisdiction where such distribution, dissemination, publication or use would be prohibited. It is not intended for people or entities to whom it would be illegal to send such publication.

Read more

Continue to