Sustainable and Responsible Investing

Moving toward a more sustainable cement?

Sustainable and Responsible Investing

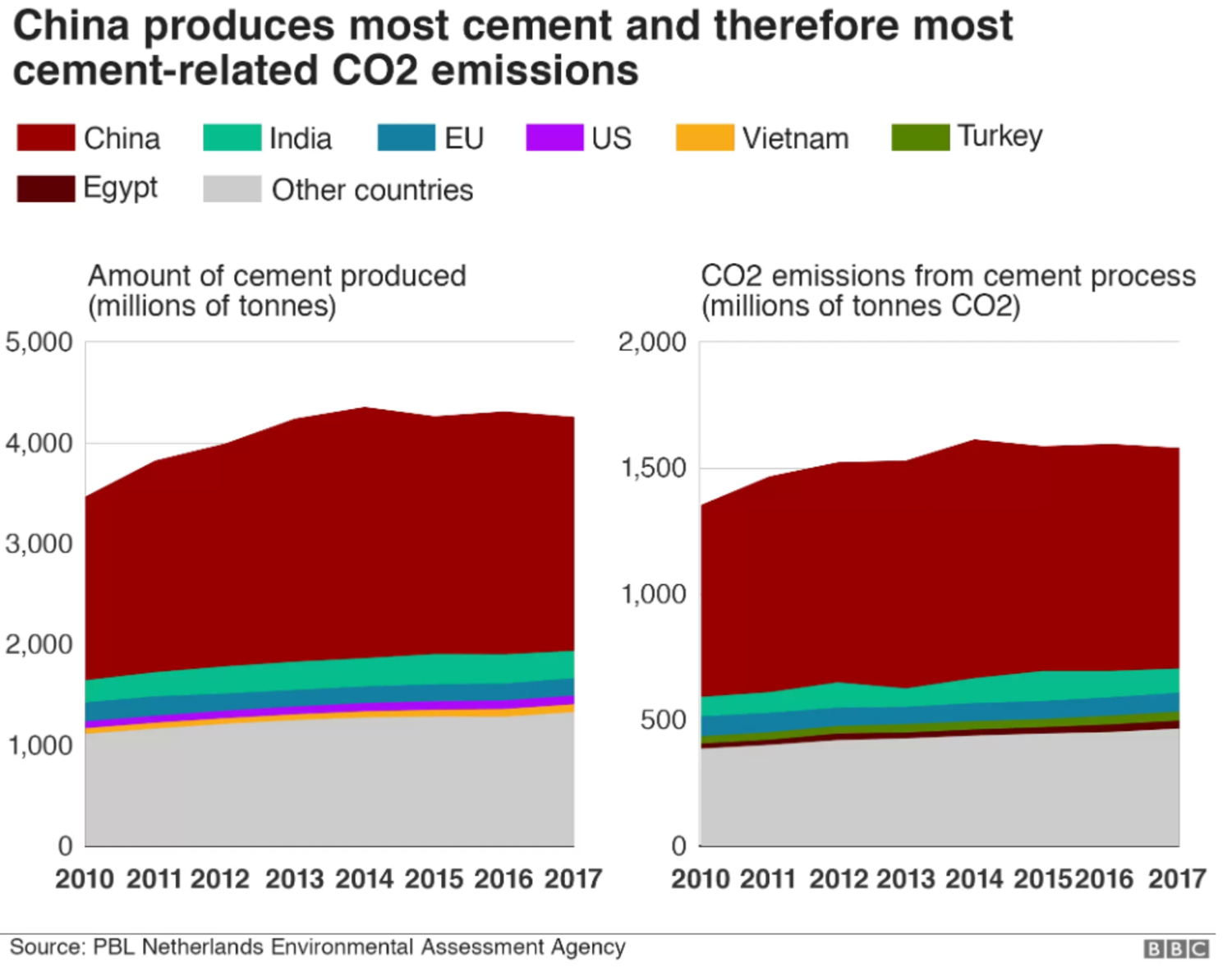

Ever since Roman times and the construction of the Pantheon and the aqueducts, concrete has been the most widely used building material in the world. This is mainly due to the numerous advantages that it offers, in terms of cost, availability of raw materials, strength, thermal inertia and solidity. Furthermore, in view of the increasing urbanisation of the world −80% of the world’s population is expected to live in cities by 2050− it meets the needs of infrastructure (health, transport, communication, etc.). Cement, which constitutes just 7 to 20% of the total composition of concrete, is responsible for 95% of its carbon footprint. With a production of 2.8 billion tons in 2020, the sector is responsible for 7% of global CO2 emissions, according to the International Energy Agency (IEA). If it were compared to a country, the industry would be the third highest polluting country in the world, behind China and the USA. Switzerland, with its abundance of modern and well-maintained infrastructure, is one of the world’s largest consumers of cement, with 4.3 million tonnes.

The industry was relatively untouched by criticism until recently, with most of it being focused on the oil majors. Environmental NGOs and investor coalitions are now directly challenging companies such as Holcim, CRH and HeidelbergCement over their commitment to climate responsibility. Holcim was sued in Switzerland in July by residents of an Indonesian island for the company’s alleged responsibility for causing a rise in sea levels and resulting damage. Additional pressure to reduce emissions per tonne of cement is coming from customers, namely the construction industry, who are demanding more environmentally friendly products to help satisfy sustainability standards.

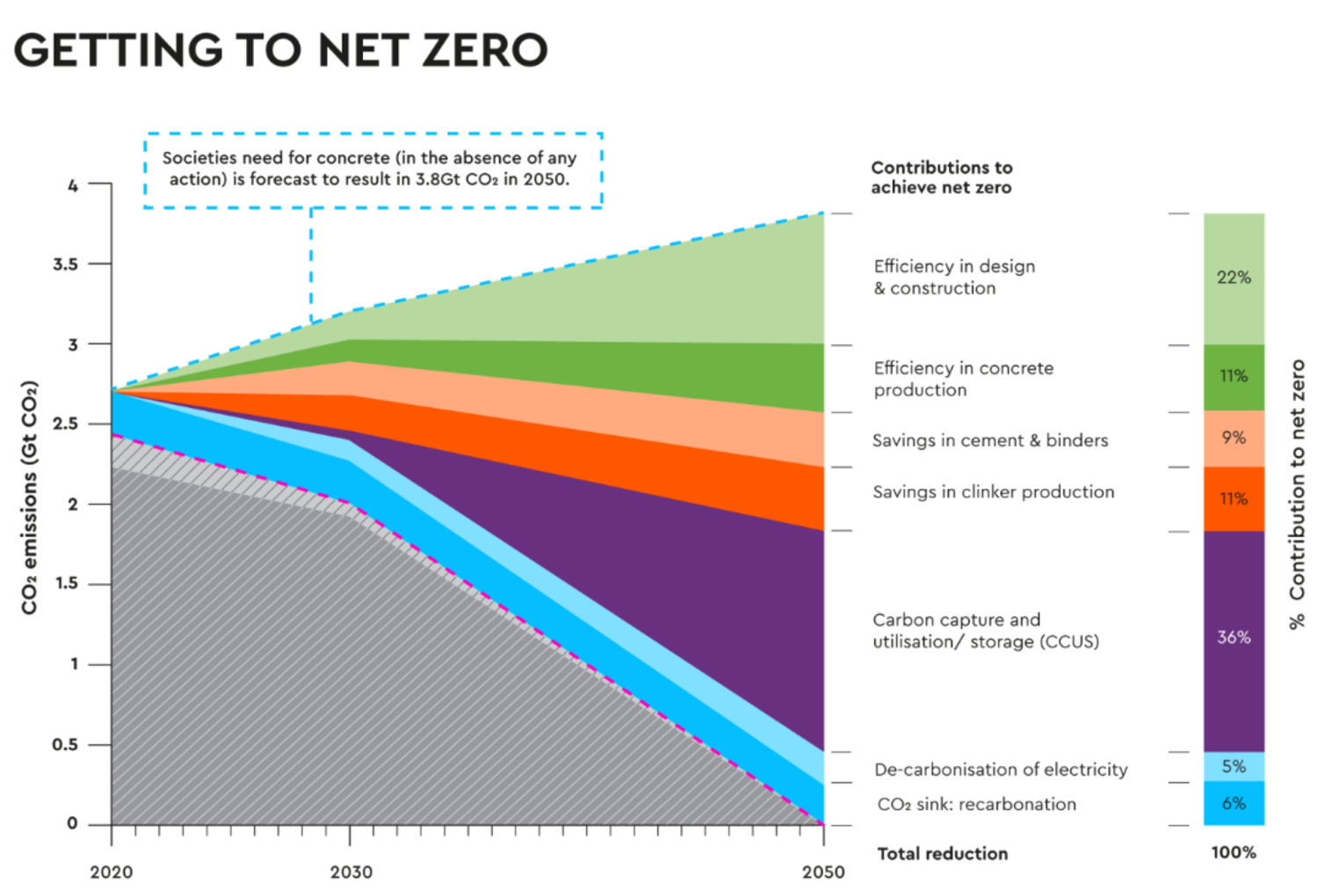

Through the Global Cement and Concrete Association, the big players have committed themselves to achieving carbon neutrality by 2050. In real terms, this would entail cement manufacturers reducing emissions from one tonne to 375 kilos of CO2 per tonne of cement produced by 2050. This target is ambitious and will be expensive if it is to have any chance of being achieved. The bulk of the emissions come from the cement manufacturing phase (around 80%), and more specifically from the chemical transformation process of clinker, which is the resulting material made by firing clay and limestone rocks at around 1450°C. Portland cement, a traditional and very environmentally unfriendly cement, contains 95% of clinker. Cement manufacturers are focusing on reducing the share of clinker in the composition of cement, using cleaner alternatives such as waste products (e.g. Fly ash). Using waste material also strengthens circular economy programmes and leads to substantial cost savings. Cement manufacturers also need to improve the efficiency of manufacturing processes. This can be achieved by investing in new sites and using cleaner fuels in the kilns. A particular example of this is the replacement of fossil fuels used to power the kilns with waste from biomass. Thanks to these measures, industry leaders such as Holcim have been able to bring down their emissions by 30% since the 1990s and are targeting a further 20% reduction between now and 2030. However, the carbon intensity directly related to cement production increased by 1.5% per year between 2015 and 2021, whilst a 3% annual reduction is needed until 2030, according to the IEA, as part of a “net zero emissions” scenario for 2050.

There are alternatives to conventional cement, but for the time being they all generate a significant carbon footprint. Therefore, the use of carbon capture and storage (CCS) techniques are seen by the Intergovernmental Panel on Climate Change (IPCC), the IEA and the European Commission as a promising solution. CCS involves fitting equipment to capture the carbon dioxide present in the smoke emissions from production sites and direct it to underground storage areas. Although criticised by environmental organisations for failing to provide sufficient incentives for polluting companies to review their business models and reduce their emissions, these solutions are nonetheless gaining interest from the major players in the cement industry. As shown in the graph below, CCS measures account for the largest share of the reduction potential between now and 2050 (around 40%).

At present, HeidelbergCement, Holcim and Cemex have launched 37 projects in this domain compared to only two in 2019. HeidelbergCement intends to use these technologies to cut 10 million tonnes of CO2 by 2030. The German cement company is currently building the world’s first large-scale carbon capture facility at its Brevik cement plant in Norway. This will enable the capture of 400,000 tonnes per year (or 50%) of the plants’ emissions from 2024. Holcim is currently exploring the further development of these solutions in Europe and the US in collaboration with Schlumberger New Energy. The (still) relatively low number of such projects can be explained by the high costs and complexity of deploying these technologies.

Nonetheless, with the combination of the political support of the European Green Deal and the US Infrastructure Deal, its introduction in the coming years is looking increasingly more profitable. This is due to the price increase of cement linked to carbon emissions −should companies do nothing to reduce their intensity− together with the planned reduction in carbon credits awarded to companies in the cement industry by the European Union. CCS measures are more necessary than ever for the cement industry if the 2050 targets are to be met, and will require significant funding from governments, together with private and institutional investors. From an investor perspective, a thorough ESG analysis can help distinguish between those cement companies that have made a serious move towards decarbonisation −often-listed European giants− and those that sit by the side-lines.

This publication is prepared by Mirabaud. It is not intended to be distributed, disseminated, published or used in any jurisdiction where such distribution, dissemination, publication or use would be prohibited. It is not intended for people or entities to whom it would be illegal to send such publication.

Read more

Continue to