Navigation

Close

Services

Corporate Finance

Since 1990 Mirabaud has offered a wide range of services for public and private companies. Its services include equity research, capital markets, corporate advisory as well as institutional brokerage.

CORPORATE FINANCE

Mirabaud provides a broad range of corporate finance and corporate advisory services aimed at helping our clients to achieve their strategic goals. Operating at the heart of markets, Mirabaud also provides institutional investors with independent and ideas based research on niche equity market segments, together with state-of-the-art execution services.

Since 1990 Mirabaud has been offering a wide range of services for public and private companies. Its services include equity research, execution, capital markets, corporate advisory as well as institutional brokerage.

Mirabaud has established itself as an expert and trusted intermediary in financial markets by offering independent advice that reflects the goals and interests of its clients. Mirabaud offers its Corporate Finance activities in London, Geneva, Zürich, Paris and Madrid.

Corporate Finance

Geneva

London

Madrid

Paris

Zurich

The View

Every day, our experts deliver fresh insights on trending topics, sectors and markets to help you stay ahead of the curve.

The current global economic backdrop has resulted in an acceleration in the pace of C-Suite executives jumping ship. On the other hand, company boards are having to assess the inbound economic hurdles and prepare for a potential downturn by hiring executives that are experienced in being defensive through a recession, taking costs out of the business and restructuring operations.

This has several consequences for investors, not least because it highlights the ‘G’ in ESG. But bringing in a new management team can often be a way of clearing the decks and kitchen sinking guidance, which could lead to a more confessional earnings outlook in the hope of passing any bad news on with the departing management. The pace of the departures may not be coincidental with the fact that companies need to start thinking about 2023 guidance. Beyond this, changing management causes disruptions to operations especially if they do not have a replacement lined up, which in turn can dent investor confidence and ultimately lead to share price declines. This means that investors must be even more forensic in their assessment of a companies’ management and be wary of those sectors that have higher churn.

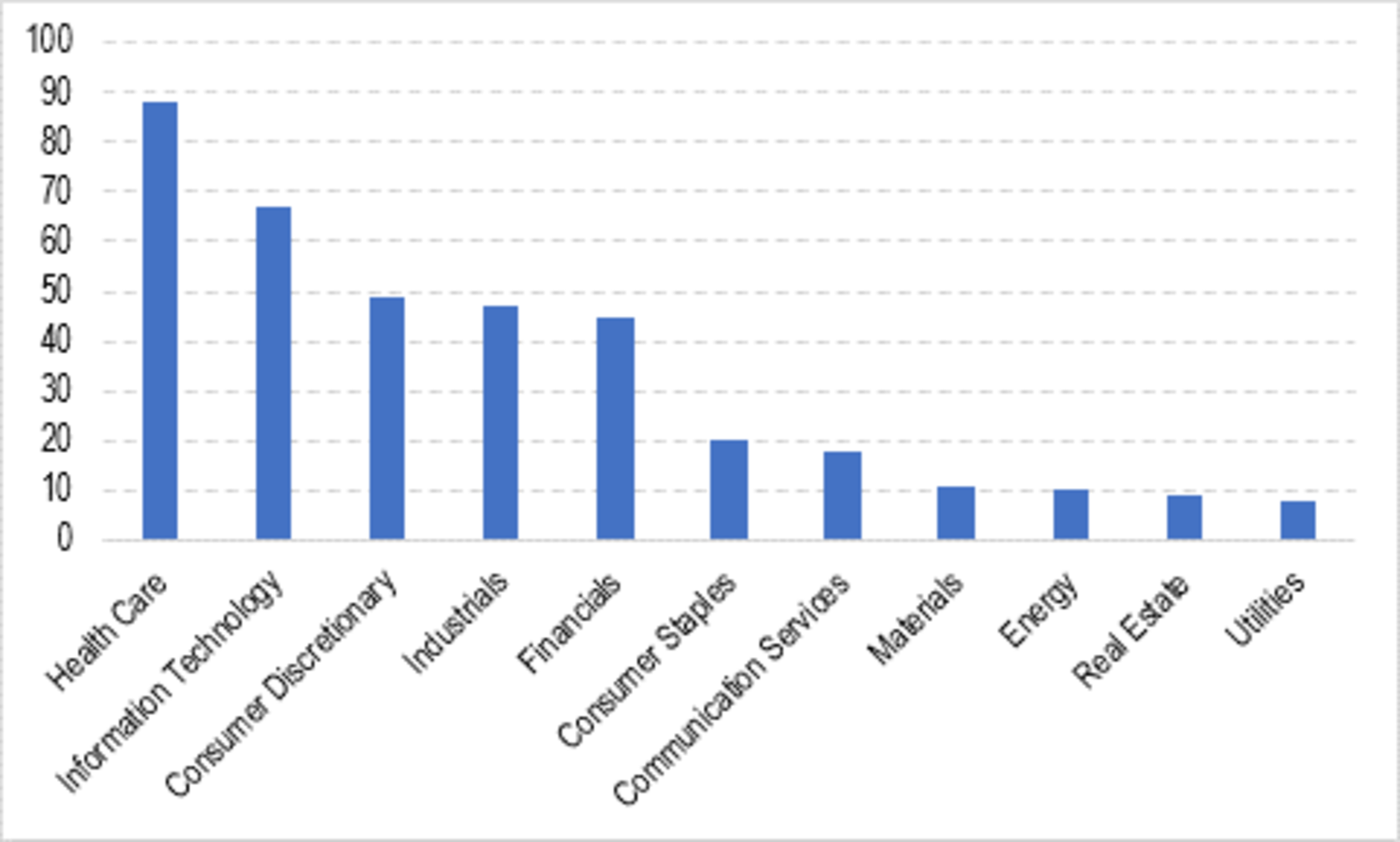

Compiling data on CEO and CFO movements across the NASDAQ Composite, S&P500, STOXX600 and FTSE100 indices we have found that the Health Care and Technology sectors generally see the highest management re-shuffles whilst Materials, Energy, Real Estate and Utility companies see significantly less top management movement.

Last year was itself big for top management changes, however, 2022 is not far behind and on a monthly viewpoint, the pace of executive changes has moved significantly higher than in the prior year, suggesting 2022 could finish higher. Finally, comparing C-Suite movements of today versus the GFC (Global Financial Crisis), we notice that not only is the level of movement 5x or 6x higher but also that in the GFC, more CEOs were changed than CFOs. There is a myriad of reasons as to why this could be, for example, from an investor perspective the changing of a CFO is seen as less damaging than changing the CEO or perhaps in a financial world dominated by the minutiae of financial models, investors place more responsibility on the CFO than CEO. For 2022, we suspect greater importance is being placed on having a CFO who is experienced with cost control and balance sheet management.

The pace of the change has stepped up in recent months and investors need to be mindful. Gauging the reason for the change is perhaps more important now than ever before as it could be used to mask an underlying decline within the business or in anticipation of a wave of cuts and operational reorganising. Indeed, the ‘G’ in ESG becomes more prevalent at a time of economic decline.

Please do not hesitate to reach out to your privileged contact person at Mirabaud or contact us here if this topic is of interest to you. Together with our dedicated specialists, we will be happy to evaluate your personal needs and discuss possible investment solutions tailored to your situation.

Continue to

Equity Research