Wealth Management

How banks are engineering an investment banking revival by 2026?

Wealth Management

In the wake of a volatile global economy and uncertainties, major banks have undertaken strategic restructuring to position themselves for stronger investment banking gains.

This includes cost-cutting initiatives, workforce realignments, and renewed focus on high-margin business lines like advisory services and equity underwriting.

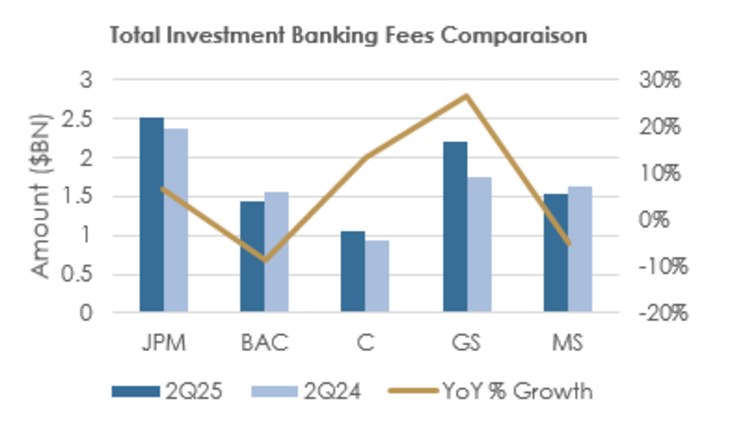

Firms such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley have streamlined operations, shedding low-performing assets while investing heavily in technology platforms. These moves are not just about managing short-term headwinds, they are a calculated effort to pivot toward areas expected to benefit from renewed capital markets activity.

Analysts view these actions as foundational plays, with the aim of boosting profitability when IPOs, M&A transactions, and capital raises accelerate again. With many companies delaying market entries until conditions improve, banks are aligning themselves to be the preferred partners when activity picks up, likely in early 2026.

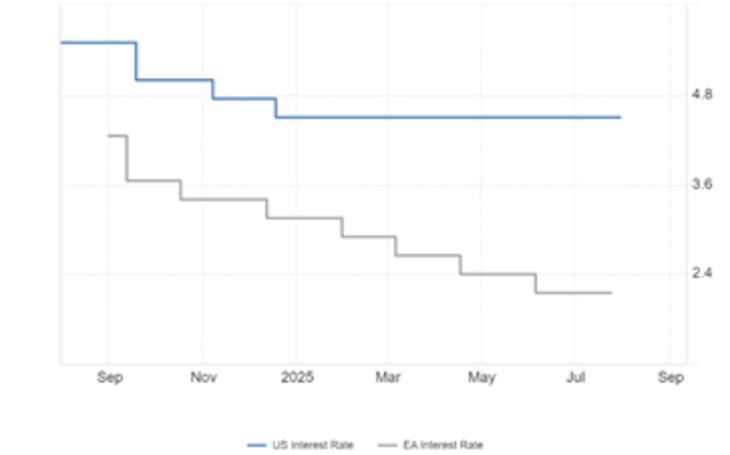

Several macroeconomic factors are setting the stage for a robust investment banking rebound. The European Central Bank has already initiated interest rate cuts, signaling a shift toward more accommodative monetary policy, while markets expect the U.S. Federal Reserve to follow suit later in 2025 as inflationary pressures ease.

This divergence in policy paths still points in the same direction: a more favorable borrowing environment on the horizon. As financing conditions improve, corporate confidence is expected to rise, unlocking a wave of delayed mergers, acquisitions, and IPOs.

At the same time, global supply chain normalisation and easing geopolitical tensions are reducing uncertainty conditions under which capital markets typically thrive.

Lastly, vast amounts of unallocated capital estimated in the trillions across private equity and venture funds remain poised for deployment. Together, these forces suggest a potential surge in deal activity, and banks are preparing now to convert that momentum into revenue through early 2026.

Top-tier investment banks are leveraging technology and human capital as core differentiators. Over the past 18 months, firms have increased investment in AI, predictive analytics, and digital client onboarding to streamline deal execution and improve client engagement. These innovations reduce time-to-market for deals and offer better data-driven insights for corporate clients navigating complex financial decisions.

Banks are simultaneously rebalancing their talent pools retaining top-performing dealmakers, while selectively hiring from fintech and boutique advisory firms.

This blend of traditional banking and technological expertise positions firms to win mandates in a competitive landscape. By early 2026, those that have successfully integrated tech and talent will be able to service a broader range of clients, from moderate growth firms to global conglomerates, more efficiently. This fusion is not just a trend, it is a strategic pivot toward a more agile and scalable investment banking model.

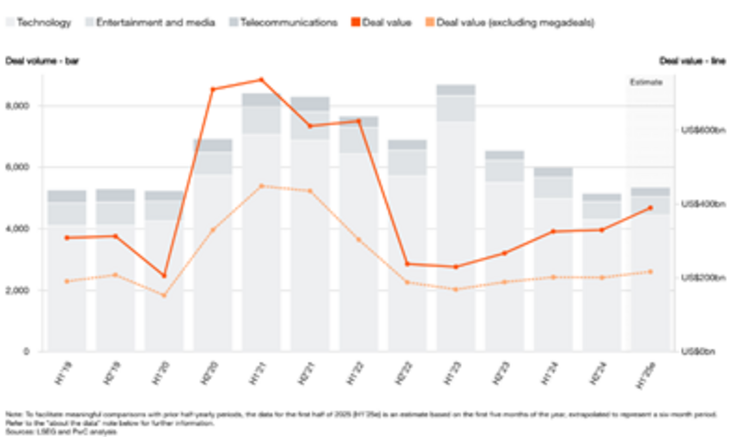

A key driver of future investment banking revenue will be client readiness, and signs are increasingly positive. Many companies that paused capital raising or M&A activity during the 2022–2024 market turbulence have maintained strong balance sheets and are preparing to reenter the market.

Sectors like technology, healthcare, and clean energy show particular promise, buoyed by secular trends and government incentives. For example, the Inflation Reduction Act in the U.S. has catalysed investment in renewable energy, while AI and biotech innovation continue to fuel investor interest.

Banks are already holding advanced discussions with clients in these sectors, preparing roadshows and structuring deals for launch in late 2025 or early 2026. This proactive engagement suggests that once conditions are ripe, transaction flow could surge quickly.

Investment banks are not just reacting to recent challenges, they are gearing up for what is next. Restructured teams, smarter tech, and a sharper focus on clients mean they will be ready to jump in once deal activity picks up again. With the right conditions lining up through early 2026, those who prepared early will be front and center when the market bounces back.

This publication is prepared by Mirabaud. It is not intended to be distributed, disseminated, published or used in any jurisdiction where such distribution, dissemination, publication or use would be prohibited. It is not intended for people or entities to whom it would be illegal to send such publication.

Read more

Continue to