There is a significant pace of change in what a technology company should now be focused on (as directed from investors, bankers and VCs). GAAP (Growth at any Price) strategies (not to be confused with GAAP accounting), popular in the era of scarce growth and low rates - appears to be dead. The new buzz word for the next 12 months is likely to be ROI (Return on Investment). In this fast-changing macro environment, companies will likely need to change their philosophy and seek tangible ROI and defensible margin structures. The Tech world is always full of jargon, buzz words and acronyms. What buzzwords does ROI replace? TAM, SAM and SOM. (TAM = Total Addressable Market for your product or service, SAM = Service Addressable Market, the percentage of TAM you can focus on based on your targets and business model, and SOM = percentage of SAM you can realistically capture.) These were the buzz acronyms which had morphed from the VC world into the public corporates. For example, Uber, who pitched that they could expand the TAM. Or Coinbase suggesting a nascent market was going to explode –“explode” could now probably be replaced with “blow up”. Storytelling, optimism and high risk appetite worked well in a backdrop of QE. The problem is, we are now in a world of QT, and tangible path to profitability, evidence of cash flow rather than cash burn and disciplined strategy are back in vogue.

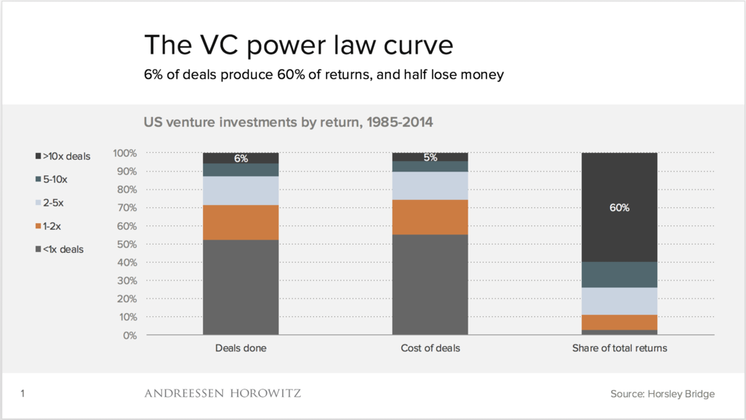

Perhaps the next outcome is also reflective of the VC world? What do we mean by this? Let us remember the “VC Power Law Curve” which was provided by a huge data analysis by Horsley Bridge of 7,000 investments over 30 years. Just 6% of deals produced at least a 10x return and made up 60% of total returns. And half of all investments returned less than the original investment. In other words, there will be a company which has a series A with a TAM which, for example that is focused on books, that can move into adjacent markets (hello Amazon, 1995). But there are many that can’t expand the TAM, or move into adjacent markets, or become the first to scale in a nascent market. This current reset means we need to change the focus, and not assume it is safe to maintain a high burn rate while hoping for a quick “V” recovery. It is not to say that there isn’t an innovation super cycle because we can see that there has been decades-long digital transformation of the global economy. But just like investors reviewing their portfolios against inflation and rising rates, so corporates need to prepare for an inflationary cycle. One potential impact of margin compression caused by higher operational costs could be an increase in the number of “zombie companies” – those that may struggle to repay debt after increasing leverage during the era of ultra-low interest rates. Between 2015 and 2019, roughly 10% of public companies were considered zombies, according to the Federal Reserve.