Weekly Thoughts by Mirabaud Securities - 24 January 2020

Swiss market extends gains this week to 7th straight session and hit a fresh record on Wednesday. The virus and its potential impact on the economy and financial system pose a growing challenge for President Xi Jinping. It comes at a time when the Communist Party is seeking to maintain stability in the face of a trade war with the U.S., the spread of swine fever, a debt mountain, rising corporate defaults and protests in Hong Kong. Over the week, the main American indices ended down. Leaving aside the Swiss market, European indices followed the same negative trend, despite the release of a better German ZEW than expected. In Asia, most of the indices were dragged down by the coronovirus income.

Against the safe-haven yen and the Swiss franc, which tend to draw investors during times of geopolitical, financial stress or pandemic, the dollar was lower on the week. The pound benefitted from hopes that the Bank of England (BoE) will avoid cutting UK interest rates next week. At the G10 level, excluding the Japanese yen and the Pound, the Swedish krona finished the week positively against the dollar. The Norwegian krona was the worst performer. At the emerging market level most of the members' currencies (against the dollar) experienced decreases over the week with a significant underperformance for the Chinese yuan and the South Korean won. Still in emerging markets, there were also notable increases in the Colombian peso and the Russian rubble. The South African rand was the biggest gainer (against the dollar) on the week.

Rhodium - mainly used in auto catalysts and five times more costly than gold - surged 31% already this month, touching the highest since 2008. Stricter emissions rules have fuelled a multiyear rally and there’s speculation that investors are also jumping in, betting that prices will climb toward a record. Rhodium rallied 12-fold in the past four years, far outperforming all major commodities, on rising demand from the auto sector. Although pullbacks are possible this year, rhodium could top the record $10,100 set in 2008. Higher rhodium prices are good news for South African producers, which account for more than 80% of global output. Gains in platinum-group metals and a weak rand helped a stock index for the nation’s miners to triple in the past year, reaching the highest since 2011. The market for the metal is only 1.1 million troy ounces, or about 34 metric tons of annual demand. That makes it about 10% of the palladium market, about 15% of the platinum market, and less than 1% of the size of the gold market.

On 31 December 2019, WHO was alerted to several cases of pneumonia in Wuhan City, Hubei Province of China. The virus did not match any other known virus. This raised concern because when a virus is new, we do not know how it affects people. One week later, on 7 January, Chinese authorities confirmed that they had identified a new virus. The new virus is a coronavirus, which is a family of viruses that include the common cold, and viruses such as SARS and MERS. This new virus was temporarily named “2019-nCoV.” On Wednesday, Chinese authorities have reportedly suspended all outbound air and train travel from the city, expanding on their edict that nobody leaves, and nobody enters, the city in central China, which has a population of 11 million people, making it larger than New York City. If China’s new coronavirus turns into a prolonged outbreak, the country’s travel and leisure industry will likely be among the hardest hit as well as the luxury sector. Finally, the virus also comes as Chinese are expected to make about 3 billion trips for the Lunar New Year that officially kicks off on the 24th of January.

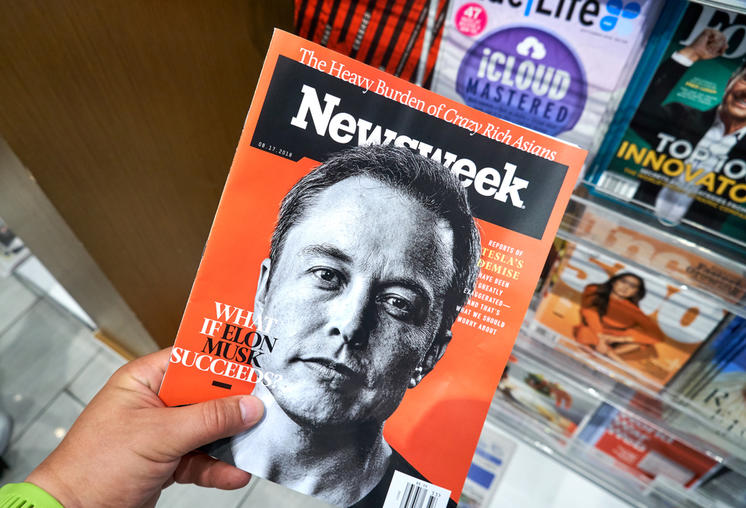

Tesla’s stock price surged more than 10% this week, boosting its market capitalization to over $100 billion. It made the electric automaker more valuable than Volkswagen. Tesla shareholders have been enjoying a seemingly unstoppable rally for the past month that saw Tesla’s stock pushed to new highs. The company’s valuation has surged past several automakers to become the most valuable US automaker. Now it has surged past even Volkswagen, an automaker who produces millions of vehicles per year. At just over $100 billion, Tesla’s market capitalization is now second only to Toyota, which has quite the lead over everyone else. Icing on the cake, Elon Musk, chief executive officer of the company, will secure a pay bonus of around $350 million if the electric carmaker's market capitalization averages over $100 billion over a six-month period.

Several hot topics were discussed this week, including:

August review / American yields are too… high / Is value dead (again) / Walking Dead / The Jeremy Corbyn put

Please feel free to ask for more information if interested.

* On the cliff

SWOT stands for Strengths, Weaknesses, Opportunities and Threats, the French equivalent of FFOM analysis (Forces, Faiblesses, Opportunités et Menaces). While SWOT analysis can be used to develop a company's marketing strategy and evaluate the success of a project (by studying data sets such as company's strengths and weaknesses, but also competition or potential markets), I decided several years ago to adapt it as a way to analyse financial markets. SWOT analysis allows a general development of markets by crossing two types of data: internal and external. The internal information taken into account will be the strengths and weaknesses of the market. The external data will focus on threats and opportunities in the vicinity. Finally, and most interestingly, there is a table that will evolve according to current events, which will allow it to reflect the underlying trend in the financial markets on a weekly basis.

Diese Veröffentlichung wurde von Mirabaud erstellt. Sie ist nicht zur Verteilung, Verbreitung, Veröffentlichung oder Nutzung in einer Gerichtsbarkeit bestimmt, in der eine solche Verteilung, Verbreitung, Veröffentlichung oder Nutzung untersagt wäre. Sie ist nicht für Personen oder Unternehmen bestimmt, an die die Übersendung dieser Veröffentlichung rechtswidrig wäre.

Mehr lesen

Author

Weiter zu