China property prices

Since late 2020, we at GTS have been discussing negative developments in the Chinese property market, with particular reference to the larger Chinese developers.

By way of background, on our last visit to China almost a decade ago, there was clear evidence of overcapacity of all kinds (commercial, residential, infrastructure). Rather than cutting back and discouraging more investment, however, the Chinese Government subsequently continued to encourage yet more development. This has resulted in much employment being created, thereby ensuring continuing social harmony, but also lots of unnecessary residential and commercial infrastructure, which (for now) has mostly sold.

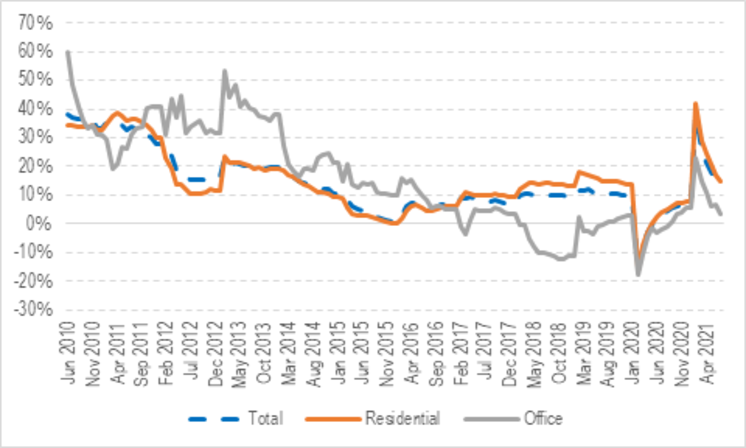

Chart 1. Chinese real estate investment YoY %

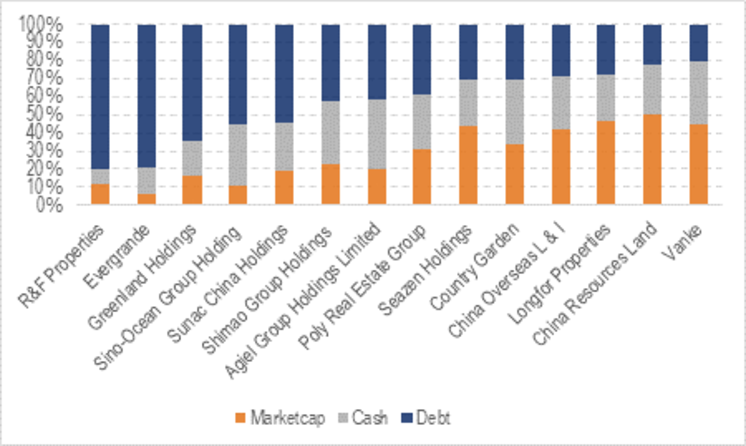

Since early 2021 however, worries have grown regarding the solvency of a handful of the larger Chinese property companies. Whilst the general assumption has been that the Government will stand behind them and will not allow them to collapse, this does not mean that bond and equity holders will not be affected along the way. Leading the charge here has been China Evergrande (3333 HK), which is the largest Chinese developer by Sales, recording Sales of $73bln in 2020. Their Enterprise Value is now $110bln, but it is worth noting that it has fallen 77% YTD, and just $6bln of that EV is the Market Cap and the other $100bln+ is Debt. The debt, some of which is publicly traded, has been seeing interruptions to trading recently as it has travelled lower. Some of the listed Bonds are now trading in the 25 area, including the 6.3% Coupon, due in 2024. Evergrande is not the only one. Guanghzhou R+F Properties (2777 HK), a smaller peer, has seen its share price fall36% YTD. It now has a Market Cap of just $3bln and $21bln of Debt, leading to an EV of $24bln.

Chart 2. Chinese property companies – Ranked by net debt as a % of Enterprise Value components.

It seems likely that both of these companies will have to engage in significant asset sales to service debt payments since customers are beginning to become wary of placing deposits, given all the negative headlines. These deposits are what keeps the wheels turning on a day-to-day basis, so asset sales become a high priority.

This Chinese drama may all seem very far away, but we live in a globally interconnected world as readers will no doubt be aware and there are many companies in both Europe, Asia and the US who have benefited hugely since 2010 from the never-ending construction bonanza in China. It may be about to come to a juddering halt, with relatively immediate consequences for order books. Some of the Capital Goods companies in question have seen their share prices balloon in recent years to valuations that are double or triple their historic averages. Our proprietary in-house COMPASS screening tool is starting to flash red on certain names as it is, before we add in a sudden slowdown in Chinese orders.

Diese Veröffentlichung wurde von Mirabaud erstellt. Sie ist nicht zur Verteilung, Verbreitung, Veröffentlichung oder Nutzung in einer Gerichtsbarkeit bestimmt, in der eine solche Verteilung, Verbreitung, Veröffentlichung oder Nutzung untersagt wäre. Sie ist nicht für Personen oder Unternehmen bestimmt, an die die Übersendung dieser Veröffentlichung rechtswidrig wäre.

Mehr lesen

Weiter zu