Equity Research

High-speed renewable energy (without crashing)

Equity Research

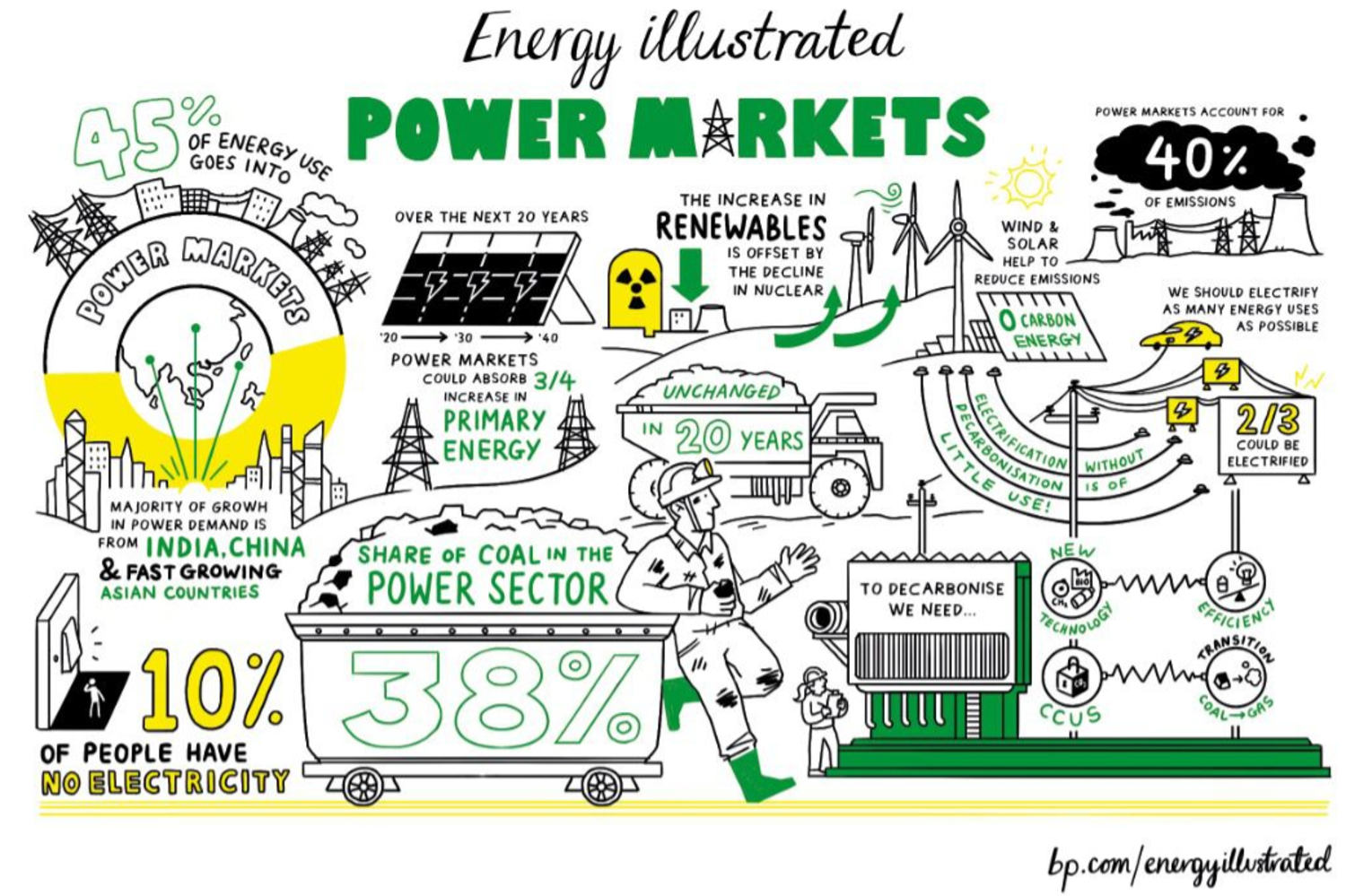

We are witnessing the biggest change to take place in the energy model in the last few centuries. Some see it as a climatic emergency and others as a search for alternatives to fossil fuels (chiefly coal, gas and oil), which still account for over 80% of energy consumed worldwide. No matter how you see it, it is essential that progress is made in renewable technologies in order to reduce greenhouse gasses, especially CO2, and harmful emissions. If we are going to decarbonise the economy, progress will have to be made in several areas and through several industries, not only that of electricity. Electrification in areas such as transport (electric vehicles), buildings (energy efficiency) and industry (green hydrogen) will be the key to meeting the target of carbon neutrality in 2050.

In Europe, abundant resources are to be put toward the financing of climate-related projects. In order to reduce emissions by 40% by 2030, an additional 260 billion euros a year in investment is needed, according to the European Commission. As a result of these efforts, the regions that are hit the hardest by the transition toward a greener economy are to receive significant support, and it is expected that investment will be more effective, in line with the European Green Deal and post-COVID recovery.

In any case, the energy transition will be coherent and viable only if it is guided by efficiency criteria to avoid oversized electric systems and excessive costs. Oil was the most relevant source of energy in the 20th century because it was cheaper and more efficient than coal, which led to its widespread use as a means of furthering economic well-being. The world still runs on oil and gas, which account for over 55% of energy consumed.

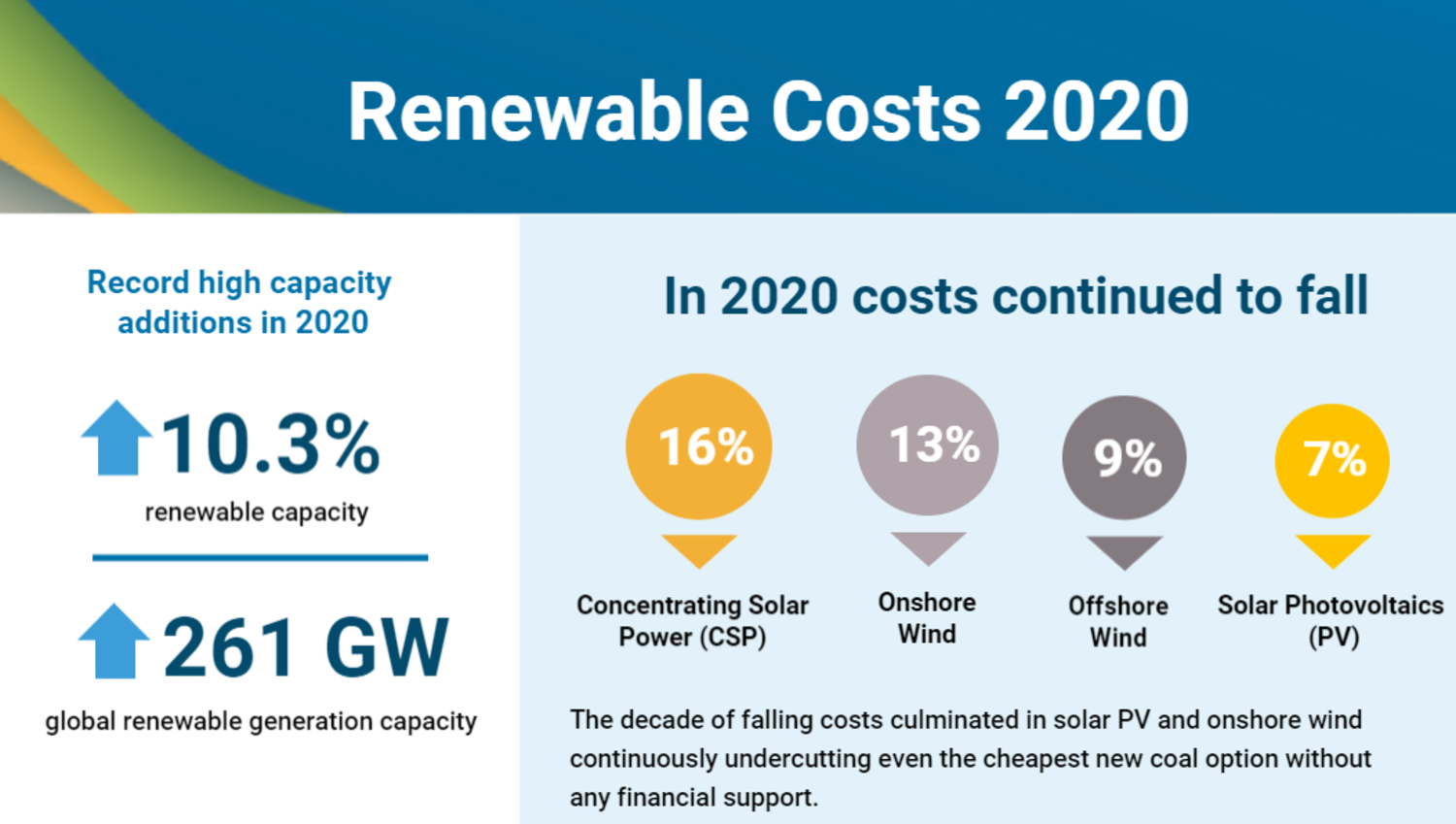

New technologies are replacing fossil fuels as a result of improvements in efficiency, and they are often a more competitive alternative. The International Renewable Energy Agency (IRENA) has indicated that these technologies are now available at competitive costs that are on a downtrend (reductions of 7% for photovoltaic and 16% for solar thermal in 2020). We believe that investment must remain in step with progress made in the development of new technologies. If new technologies are competitive, it will be possible to ensure that society benefits from them and that industry remains competitive. Otherwise, the energy transition will likely end in failure.

However, the process will require further development of technology and a solution to the problem of storage. At this time, the most widely used renewable technologies (wind and solar) are still in need of effective solutions to two problems: i) intermittency, which makes it impossible to take actions in the adjustment, regulation and programming of the electric system, the demand for which fluctuates within a single day as a result of random events, and ii) storage on a massive scale, as there are currently no technologies that make it possible. As a result of these limitations, no progress can be made in technological development and fossil fuels such as gas and coal are still needed to maintain the system in acceptable conditions. It is thought that, over the course of the energy transition, natural gas will play an increasingly important role in the adjustment of intermittencies and the setting of prices, and that it will help to further reduce dependence on nuclear power and coal. Taxation of carbon emissions is another factor that will probably draw attention to the advantages of renewable technologies and diminish the appeal of fossil fuels. In this matter, regulatory authorities will have to consider energy policies that are aligned with all objectives.

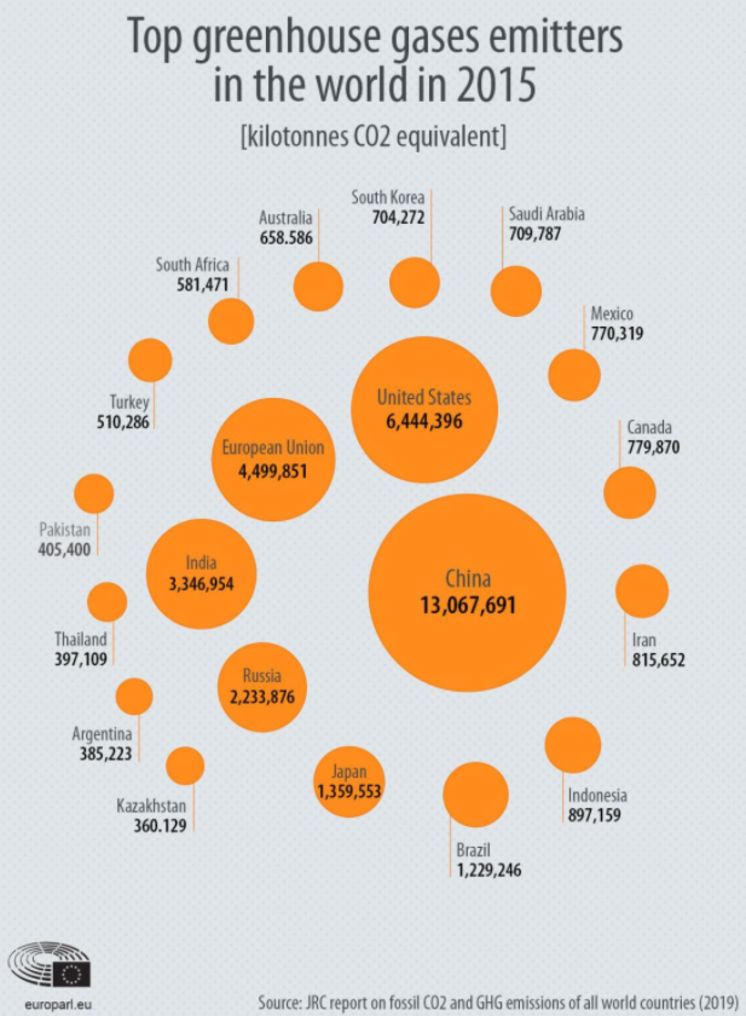

Efficiencies are now more necessary due to different countries undertaking transition at different speeds. It must be assumed that the process of achieving carbon neutrality necessarily involves certain costs and a risk of loss of competitiveness of domestic industry to the benefit of other countries that emit much more CO2. Although developed economies are leading the energy transition, emerging and developing economies account for two-thirds of worldwide emissions at this time. There will be advantages to carbon neutrality in the long term, but countries such as China will probably be more competitive, as its carbon-neutrality target has been set for 2060, which is 10 years behind Europe’s objective.

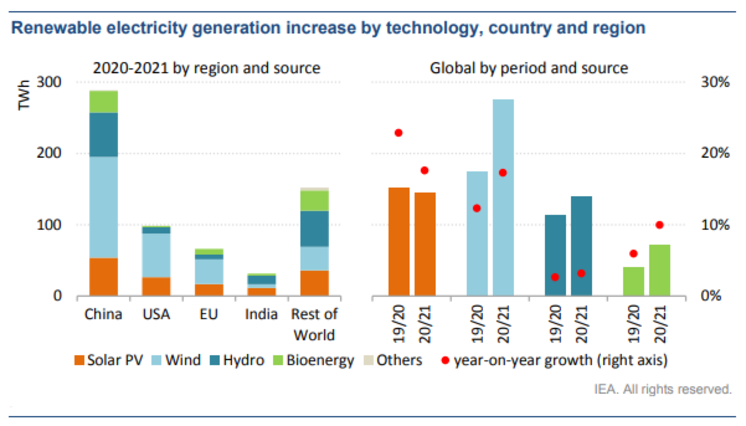

Transition creates opportunities in equities. Investors in renewable technologies must take the right decisions in regard to equities in order to take positions in companies that have adapted to these circumstances in the best ways in several aspects (technological and financial capacity, etc.) At this time, most of the projects undertaken by renewable generators of electricity are contributing to cost reductions and competing efficiently with fossil fuels while simultaneously contributing to the energy transition. Companies must take advantage of current facilities to access financing of their projects, but they must not lose sight of the fact that central banks’ expansionary policies may change. Investment must be prepared under demanding criteria of return, as it is expected that the energy transition will take place very quickly and will see many unforeseen changes. New technologies will appear, and the proper allocation of resources will be essential insofar as obtaining acceptable return on investment. It is estimated that renewable energies will account for over half of the increase in the generation of electricity worldwide in 2021 and that photovoltaic and wind power will make the greatest contribution. Renewable energies will probably account for nearly 30% of the total electricity generation this year—the single greatest contribution ever—vs. less than 27% in 2019. For these reasons, investment in renewable energies must preserve competitiveness and be made under demanding criteria in order to make quick progress in the right direction.

Por favor no dude en comunicarse con su persona de confianza en Mirabaud o contáctenos aquí si este tema es de su interés. Junto a nuestros dedicados especialistas estaremos encantados de evaluar sus necesidades personales y discutir posibles soluciones de inversión adaptadas a su situación.

Learn more about our equity research thematics here.

Continuar con

Corporate Advisory