Navegación

Cerrar

Servicios

Corporate Finance

Desde 1990, Mirabaud ofrece una amplia gama de servicios de asesoramiento y ejecución a un creciente número de empresas cotizadas y privadas. Su oferta comprende análisis financiero, servicios de ejecución, conocimiento especializado en mercados de capitales, financiación e intermediación institucional.

Case study

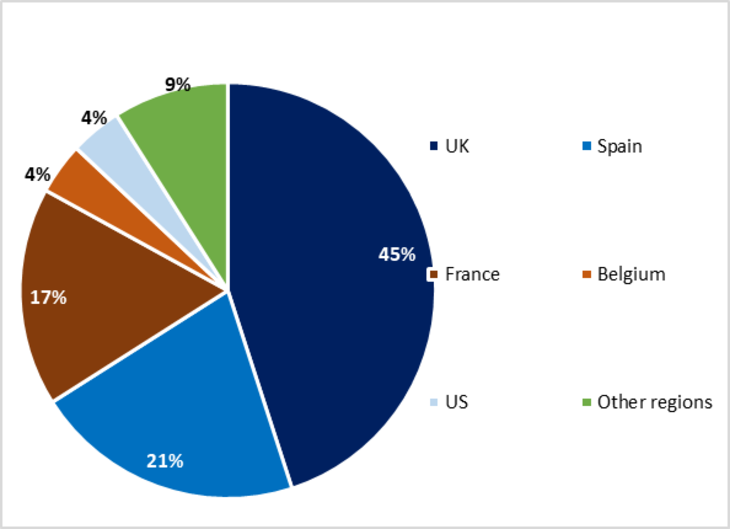

Mirabaud advised Árima, a Spanish real estate investment company, on its accelerated book building offering. Mirabaud acted as bookrunner for the transaction, just six months after Árima’s IPO (October 2018) in the Spanish Stock Exchange.

Issuer | Árima Real Estate Socimi, S.A. |

Sector | Real Estate (SOCIMI) |

Transaction type | Accelerated Book-building Offering (ABO) Capital increase without rights |

Offer size | €40m (4m shares; €10 face value) (40% pre-money / 28.6% post-money) |

Mirabaud role | Bookrunner |

Case Study

Corporate finance

Head of Corporate Finance & Capital Markets