Navegación

Cerrar

Bienvenido a Mirabaud

Bienvenido a Mirabaud.

Nuestra razón de ser: servir a nuestros clientes y ayudarles a navegar a través de un mundo complejo. De igual modo, contribuimos a que el sector financiero evolucione hacia una sociedad mejor y más justa para todos.

Así lo hacemos desde más de 200 años.

Grupo Mirabaud

Nuestro principal negocio son los servicios de gestión patrimonial para particulares, familias y emprendedores. Incluye la gestión discrecional, servicios de advisory y planificación patrimonial.

DescúbraloMirabaud AM se centra en la inversión activa en todo el espectro global de la renta fija, renta variable y activos privados. Apoyamos a nuestros clientes mediante estrategias de inversión sostenibles y de alta convicción.

DescúbraloMirabaud ofrece una amplia gama de servicios para empresas públicas y privadas, que abarca el análisis de renta variable, los mercados de capital, corporate advisory y la intermediación institucional.

DescúbraloContemporary Art

Like artists who seek to capture the spirit of the moment, wealth management requires a deep understanding of the present, while looking to the future. Creativity and passion are fundamental to any kind of innovation, to rethinking oneself and being open to new opportunities. It is in a spirit of sharing and dialogue that Mirabaud has been actively involved in the promotion of contemporary art for several decades.

After several decades of commitment to promote contemporary art, Mirabaud became a partner of the Centre Pompidou in 2022.

Know moreGrupo Mirabaud

Atendemos a una clientela exigente que busca a un socio de confianza. Trabajamos para personas que quieren ser consideradas como un nombre, y no como un número, y que comparten nuestra mentalidad emprendedora, nuestro enfoque no convencional y nuestros valores responsables.

Foco en los clientes

Servicios a medida para gestores patrimoniales independientes exigentes

Sostenibilidad

Para alcanzar el objetivo de responsabilidad económica del Grupo Mirabaud de ofrecer una amplia gama de productos y servicios responsables y sostenibles, en Mirabaud Wealth Management procuramos ofrecer productos y servicios de alta calidad que integren criterios ESG. La gestión de los riesgos ESG, así como la promoción de las temáticas ESG, son factores clave de nuestro enfoque ISR global.

Historically, the integration of ESG factors has focused on equities and corporate bonds. Today, the ESG approach extends to all asset classes in a portfolio

Lea el artículo (en inglés)Servicio

Cómo integramos los criterios ESG en nuestras soluciones de inversión responsable y sostenible

Descúbralo

Above all, this stance reflects a relentless business strategy of differentiation aimed at generating fresh revenues in the highly competitive advertising market, the ‘victims’ of which are Facebook (Meta) and Google (Alphabet). This commitment to privacy is not without its critics, however, given some of the concessions made by the group, particularly those to China.

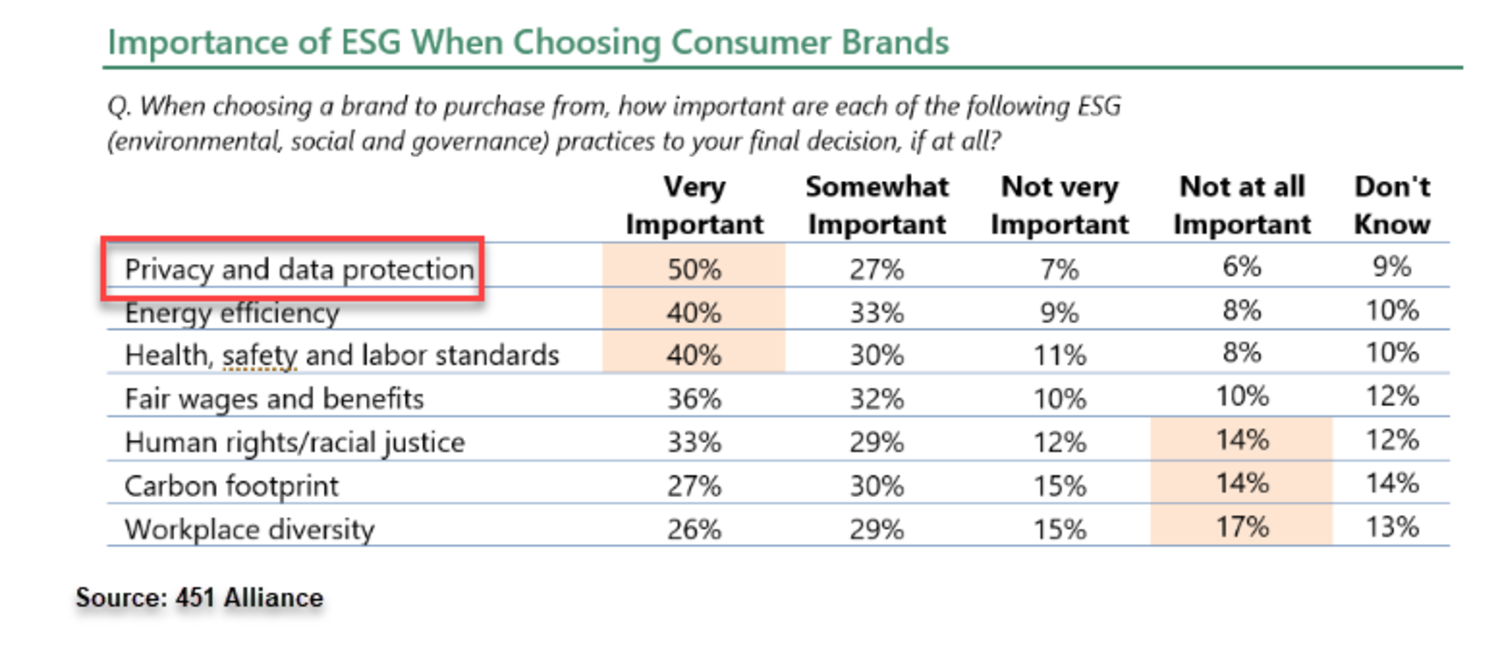

Personal data is worth its weight in gold, and its exploitation represents a major Big Data market, with a value estimated at around USD 277 billion in 2019. The data economy is expected to be worth USD 400 billion by 2025, according to the same estimates. Its protagonists are mainly social media (Twitter, Facebook and Instagram), search engines including Alphabet, application developers, as well as data merchants and advertising companies. This data is collected and subsequently sold to third-party companies to refine the profile of consumers and target advertisements. This sea of information contains sensitive individual data on matters such as the health, political or sexual orientation, or religious beliefs of the users of these tech tools. Their harvest and exploitation have become a growing issue of consumer concern ─a key regulatory issue─, and a strategic concern for responsible investors when considering GAFAMs as a potential investment. The Cambridge Analytica scandal of 2015, associated with the siphoning off of the personal data of 87 million Facebook subscribers, played a major part in raising awareness in this respect (Cambridge Analytica developed a software program for Donald Trump’s election campaign to target millions of voters based on their profile).

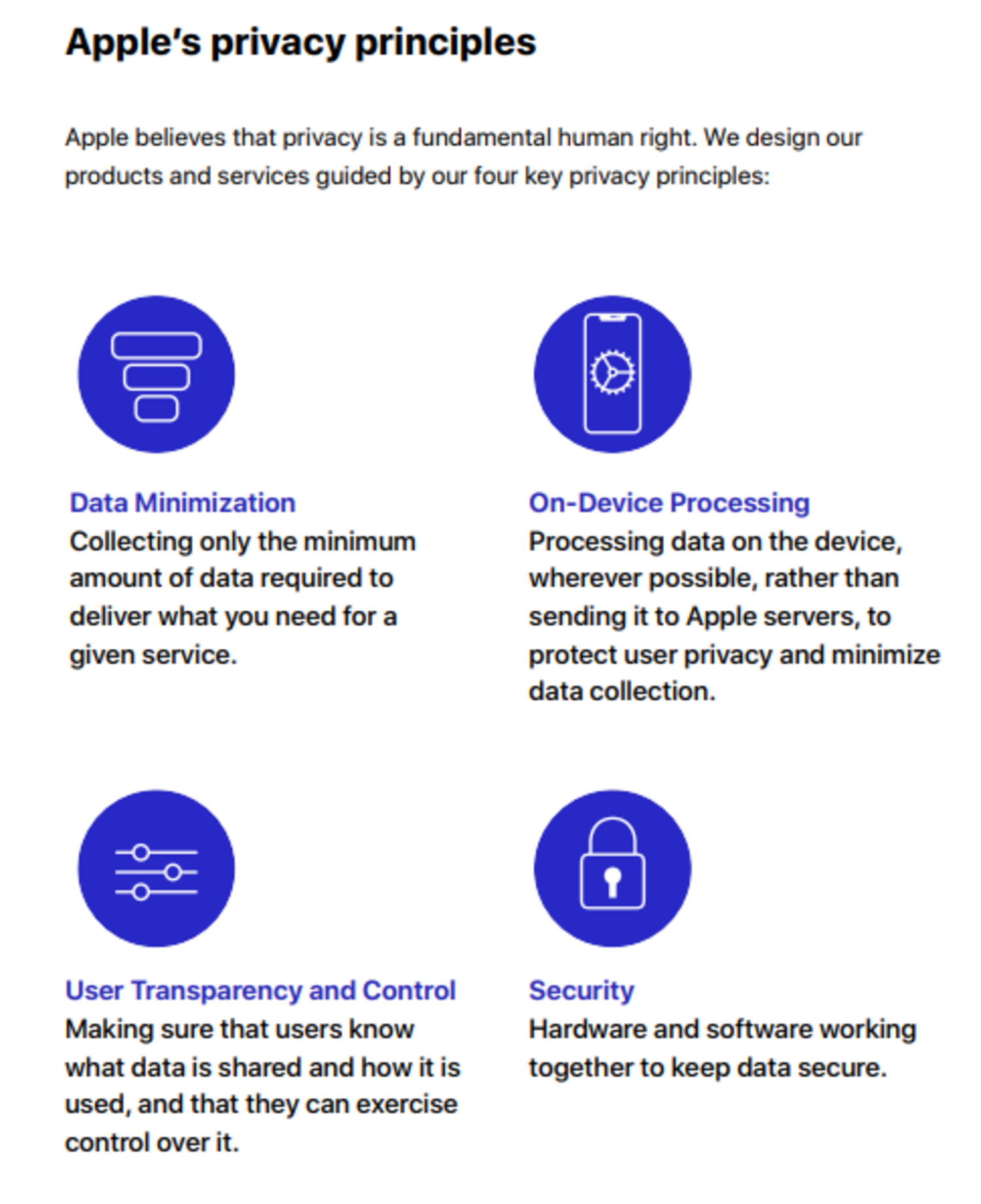

Apple has been publicly committed to protecting its user’s data and privacy for several years. A philosophical position that already pitted Steve Jobs against Mark Zuckerberg in 2010. The right to data privacy is stated and defended explicitly by the company as a basic human right. This position turned into direct frontal attacks on its tech giant competitors when Apple called for strict GDPR-type regulation in Europe (the General Data Protection Regulation (GDPR) standards set clearly defined limits on the business models of Big Data giants). Among the principles stated in its policy, Apple committed to collecting as little data as possible on its users. It has done so by making its hardware devices more “intelligent”.

Data, such as that from the Health application, is encrypted and stored as much as possible within the iPhone rather than being sent to Apple servers. The company’s privacy policy has been further tightened since April 2021, creating more barriers for its competitors to do business. Users of the iOS operating system are now able to opt out of sensitive data tracking from the apps they access more easily. In addition, App Store indicates what type of data (sensitive or not) is collected and used by applications such as Twitter. Meta’s CFO recently acknowledged that these changes have made it more difficult to target its own ads (via its apps) leading to a drop in revenue of USD 14.5 billion by 2022. Twitter, Meta, Snap and Pinterest have reported a combined total of USD 315 billion in advertising losses relating to this policy. This data privacy strategy not only helps Apple to be listed as an ESG stock by many indices and agencies, but incidentally also allows it to position itself in the advertising market and thus reap healthy revenues at the expense of its competitors. The device sector (hardware) accounted for 85% of revenue in 2021 and has fallen to 80% in 2022, in favour of services including advertising activities (USD 4 billion in revenue in 2021 and an estimated USD 30 billion by 2026).

Criticism is being focused on the China issue, with fingers being pointed at Apple’s duplicity. On the one hand, Apple systematically refuses to hand over personal information to the US authorities (including that of a Californian mass murderer in 2015) in keeping with its data protection principles, while in China the company is making sweeping concessions to Xi Jinping’s government. A New York Times investigation revealed that the company agreed to store customer data on iCloud servers run by Chinese companies and to censor certain applications such as encrypted messaging, which could help fuel the protest. Social control is a strategic issue for the regime, as we can see today with the protests of a part of the population against the Covid policy. More specifically, this means that the government can access the data of millions of Chinese residents (messages, photos, documents), stored in Apple’s China data centres. Apple’s argument is that it is strictly enforcing the country’s cyber security laws. It is all the more important to follow these legal obligations to the letter because China is of major commercial importance, accounting for 20% of their revenue in 2021. Not to mention the brand’s dependence on the country for its manufacturing. Even if Apple switches part of its supply chain to South Asia, the “world factory” that is China will still remain the primary assembly point.

As illustrated, Apple’s business model differs significantly from that of its competitors when it comes to data exploitation, and the company has even managed to turn it into a commercial advantage. Nevertheless, like many companies operating in China, Apple is adapting its data protection principles to political realities in the interests of pragmatism and maintaining sales. While Apple can be credited with some very commendable practices, it is difficult to argue that the company is the white knight of data privacy.

Por favor no dude en comunicarse con su persona de confianza en Mirabaud o contáctenos aquí si este tema es de su interés. Junto a nuestros dedicados especialistas estaremos encantados de evaluar sus necesidades personales y discutir posibles soluciones de inversión adaptadas a su situación.

Continuar con

Sustainable and Responsible Investing