Navigation

Cerrar

Services

Corporate Finance

Mirabaud bietet ein breites Spektrum an Finanz- und Beratungsdienstleistungen für Unternehmen an, die unseren Kunden bei der Erreichung ihrer strategischen Ziele unterstützen sollen. Mirabaud, das im Herzen der Märkte aktiv ist, bietet institutionellen Anlegern zudem unabhängiges und ideenbasiertes Research zu Nischensegmenten des Aktienmarkts, zusammen mit hochmodernen Ausführungsdienstleistungen.

Case study

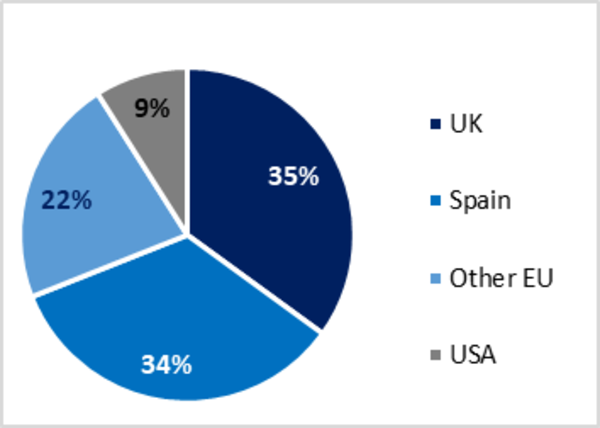

Mirabaud advised Spanish real estate investment company Árima on its IPO on the Mercado Continuo. Mirabaud acted as Joint Global Coordinator in the transaction, facilitating the entrance of a relevant portion of new investors.

In spite of the challenging environment and capital markets uncertainty, we managed to successfully place the IPO for a new quoted REIT in Spain. Moreover, our specialised equity sales platform reached the perfect investors for this transaction; institutional specialised RE funds with high market recognition that, as well as covering a relevant part of the book, also attracted smaller funds that improved the share liquidity.

Public Listing (23rd October 2018)

| Issuer | Árima Real Estate Socimi, S.A. |

| Sector | Real Estate (SOCIMI) |

| Transaction type | Initial Public Offering (IPO) |

| Mkt. Cap. | €100 m (10m shares; €10 face value) |

| Mirabaud Role | Joint Global Coordinator and Joint Bookrunner |

Case Study

Corporate finance

Head of Corporate Finance & Capital Markets